4 Crypto Whales are Selling this Week

It seems like the cryptocurrency market is experiencing some interesting movements. Let's break down the highlights:

- Dogecoin (DOGE): Despite trading near the $0.20 mark, DOGE experienced a slight dip below this level recently. However, there's still optimism surrounding its future, with potential to hit $1 following the Bitcoin halving. The price has been oscillating between $0.21 and $0.16, showing a 2% increase, and its value has risen by 7% over the last month.

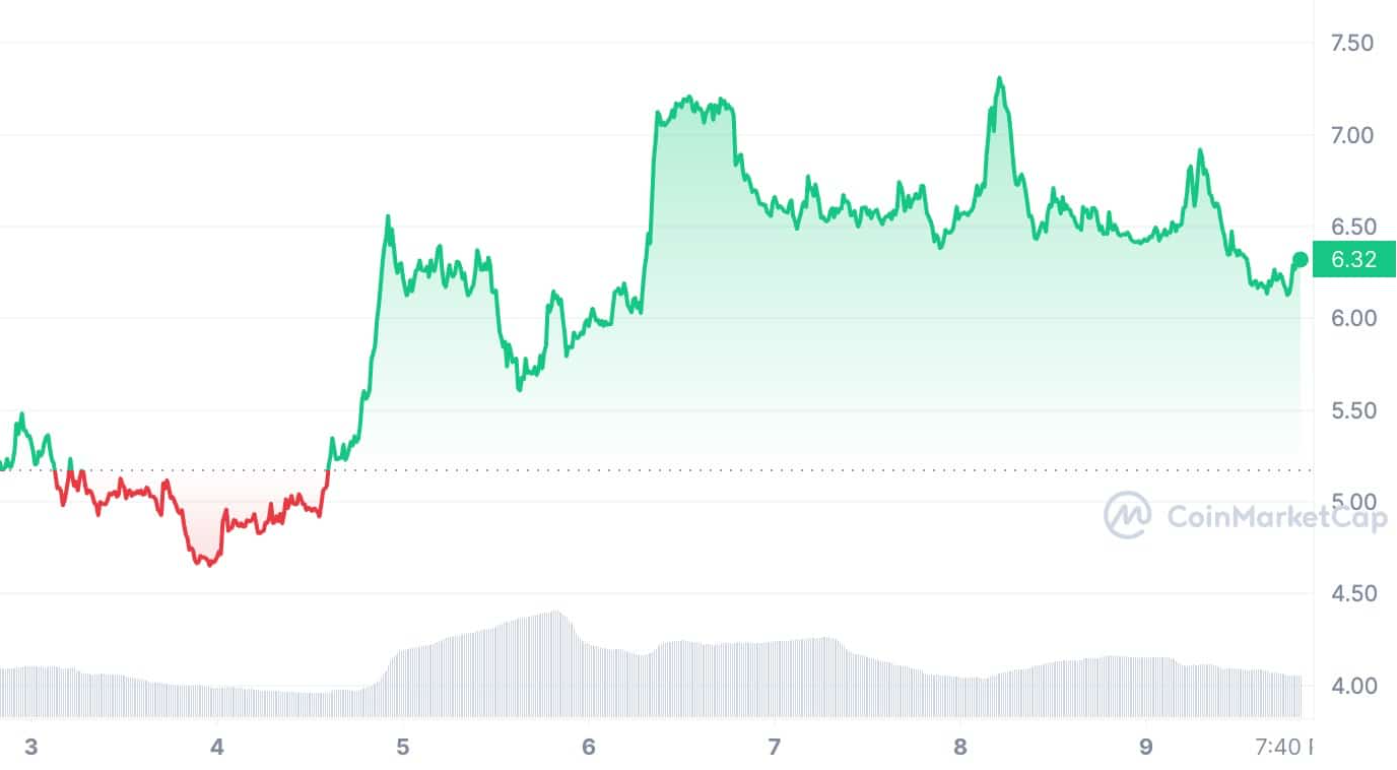

- Toncoin (TON): Toncoin hit an all-time high of $7.08, showcasing significant performance in the market. Despite a slight correction back to $6.71, its momentum remains bullish. With a growing market capitalization and a surge in trading volume, Toncoin is attracting attention, potentially aiming for the $10 mark and beyond.

- Ethereum (ETH): Ethereum saw a bullish move, topping $3,600 but waned at $3,729. It currently hovers above $3,600 support, but there's a bearish outlook from the Relative Strength Index (RSI), suggesting a possible decline back to $3,500. However, if the price rebounds from support levels, there's a chance for a breakout to $4,000 and potentially new all-time highs.

- Pendle (PENDLE): Pendle stands out with its innovative restaking protocol, offering unique features in the cryptocurrency sector. Despite a 3% decrease in value over the last 24 hours, its groundbreaking functionality in DeFi yield management is attracting attention and transforming investors' portfolio management strategies.

Overall, while the market is experiencing some volatility and mixed signals, these cryptocurrencies present both challenges and opportunities for investors, especially as they navigate the impact of the Bitcoin halving and broader market trends.

5 Altcoins Rule South Korea: Trading Volumes Are Incredibly High

It seems like there has been some notable activity on Upbit, South Korea's largest cryptocurrency exchange, with unusual trading volumes observed in several altcoins.

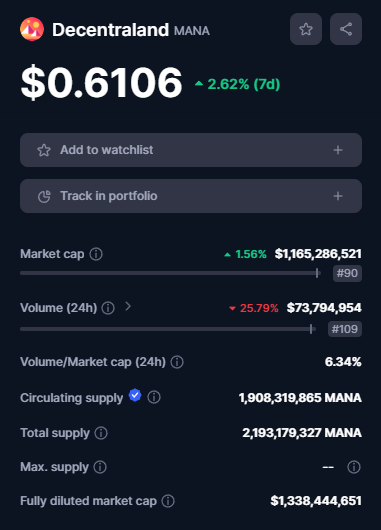

- Decentraland (MANA):

- On the 1-hour chart, MANA saw a significant increase in trading volume on Upbit.

- The average 1-hour volume rose from $246,000 to nearly $1.5 million, representing a percentage change of 560.27%.

- On Binance, the change was more modest, with the average volume increasing by 8.51%, from $559,000 to $607,000.

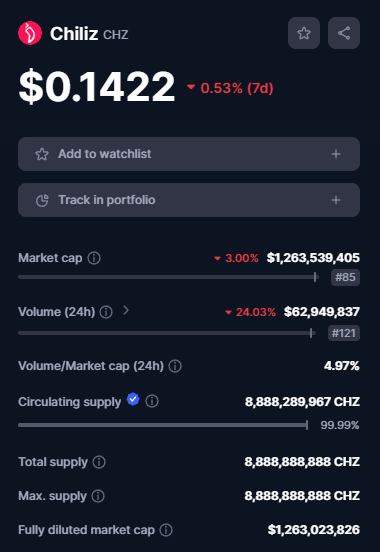

- Chiliz (CHZ):

- CHZ experienced an increase in trading volume on the 4-hour chart on Upbit.

- The average 4-hour volume rose from $14 million to around $24 million, marking a 68.92% increase.

- On Binance, the volume increased by 30.80%, from an average of $25 million to $33 million.

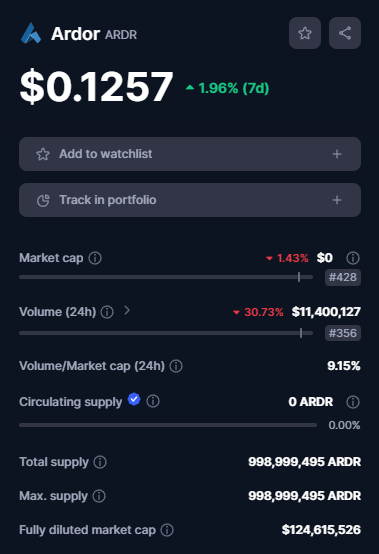

- Ardor (ARDR):

- ARDR saw a significant increase in trading volume on the 1-hour chart on Upbit.

- The average 1-hour volume rose from $7 million to $18 million, indicating a 159.19% increase.

- On Binance, the volume increased by 30.28%, from an average of $2 million to $2.6 million.

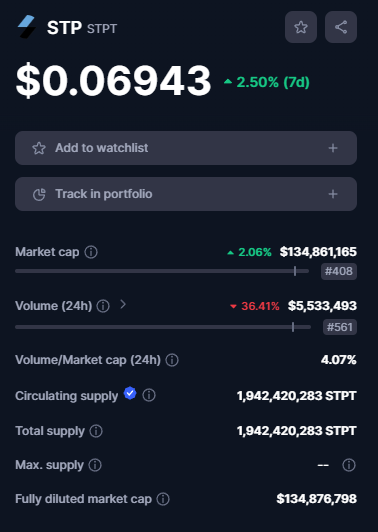

- STP (STPT):

- STPT also showed a significant increase in trading volume on the 1-hour chart on Upbit.

- The average 1-hour volume rose from $1.8 million to approximately $6 million, representing a 360.20% increase.

- On Binance, the volume increased by 22.38%, from an average of $1.7 million to approximately $2 million.

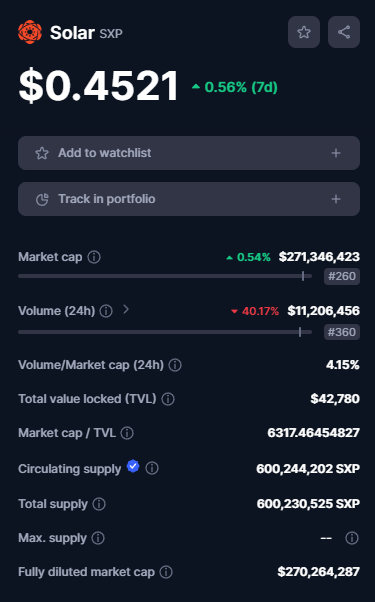

- Solar (SXP):

- SXP experienced an increase in trading volume on the 1-hour chart on Upbit.

- The average 1-hour volume rose from $384,000 to nearly $1 million, marking a 163.81% increase.

- On Binance, the volume increased by 5.19%, from an average of $366,000 to $385,000.

These unusual spikes in trading volumes on Upbit could indicate increased investor interest or potentially speculative trading activity in these altcoins. It's essential for investors to conduct thorough research and consider the implications of such fluctuations before making any investment decisions.

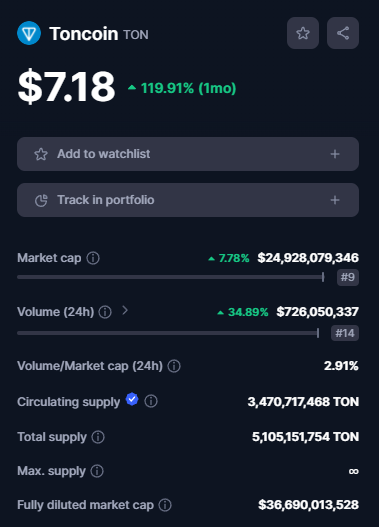

TON Coin’s Insane Ascent in Crypto Rankings

TON Coin's meteoric rise to become the ninth-largest cryptocurrency by market capitalization highlights its remarkable journey in the crypto market.

- Market Capitalization: TON Coin's market capitalization has surged to over $23 billion, surpassing well-known cryptocurrencies like Cardano (ADA). Despite being fifteenth in trade volume, its market value has propelled it to a prominent position in the crypto market.

- Integration with Telegram: TON Coin's association with Telegram, a widely used messaging platform with over 500 million active users, has been a significant driver of its value surge. Integration with Telegram's user applications and farming options has attracted investor interest and contributed to its growth.

- Innovative Projects: TON Coin's recent rally was fueled by innovative projects, including a user identity verification initiative using palm scanning technology. This initiative, along with substantial financial allocations for ecosystem incentives and development support, has bolstered investor confidence and contributed to the price surge.

- Shift in Investor Interest: TON Coin's impressive performance, with a 135% increase in value in 2024, contrasts with the double-digit decline reported by ADA Coin during the same period. This suggests a shift in investor interest towards innovative and emerging projects like TON Coin, which offer unique features and potential for growth.

Overall, TON Coin's ascent in the crypto market underscores its potential and highlights the importance of staying abreast of emerging projects and technological advancements in the cryptocurrency space.

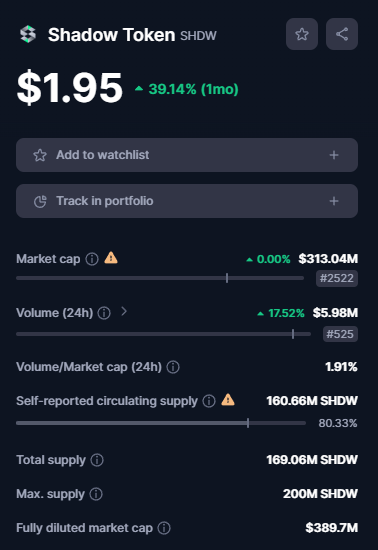

Coinbase Will List Shadow Token

Coinbase's announcement of listing Shadow Token (SHDW) on its crypto exchange marks a significant step for both the platform and the Solana network.

- Listing Details: Trading for SHDW on Coinbase will commence on April 10, 2024, at approximately 12:00 ET, contingent upon meeting liquidity requirements. Initially, trading will be available for SHDW-USD pairs in phases, once an adequate supply of the asset is secured.

- Network Compatibility: Coinbase emphasizes that SHDW is an SPL token on the Solana network. Users are advised not to send SHDW over networks other than Solana to avoid the risk of fund loss.

- Experimental Label: Coinbase has designated SHDW with an "experimental label" due to its newness to the platform or relatively low trading volumes compared to other cryptocurrencies. This label serves as a caution to users, indicating potential price fluctuations and liquidity issues.

- Risk Awareness: Coinbase encourages users to familiarize themselves with the risks associated with trading experimental assets like SHDW and exercise caution during transactions. The volatility spike experienced by SHDW following the announcement underscores the importance of risk awareness.

- Coinbase's Strategy: The decision to list SHDW reflects Coinbase's ongoing efforts to expand its cryptocurrency offerings and provide users with diverse digital assets. However, some community members have expressed concerns about Coinbase's support for altcoins with low market capitalization.

Overall, Coinbase's listing of SHDW signifies its commitment to providing users with access to a wide range of digital assets while also prioritizing transparency and risk awareness. Users should conduct thorough research and consider their risk tolerance before engaging in SHDW transactions on the platform.