Bitcoin Bull Run? $25M Raised to Expand Crypto Payment Accessibility & Crypto Grab Global Attention

Bitcoin Bull Run? [FREE PREMIUM MEMBER ANALYSIS]

- Current Status: Bitcoin's price has been fluctuating around the $43,000 mark, showing signs of recovery after falling to $42,226 on February 5th. At the time of writing, BTC was trading at $42,861.96 with a market capitalization of over $840 billion.

- Factors Influencing Demand: Analysts suggest that Bitcoin's demand might soon increase due to the upcoming halving event, which will impact the coin's issuance rate. Additionally, the recent introduction of spot ETFs could contribute to a potential supply shock, as around 80% of Bitcoin's circulating supply is liquid, and most investors are currently in profit, reducing the likelihood of selling.

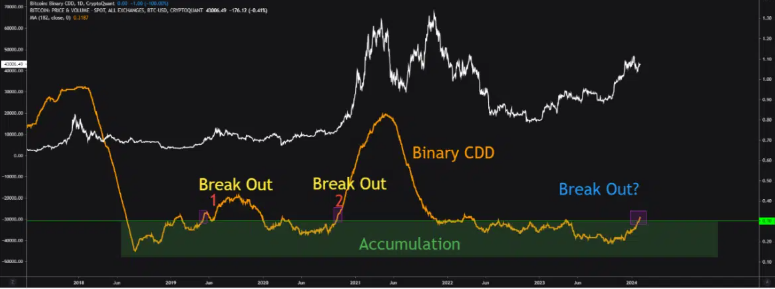

- Bullish Signals: Analysis of Bitcoin's Binary CDD metric suggests the beginning of a bullish trend, with the 182-day moving average indicating a potential upward price cycle. Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) also show bullish signs, although the Chaikin Money Flow (CMF) appears bearish.

- Whale Activity: Despite bearish sentiment, whales have been accumulating more Bitcoin, with a 2.5% increase in the number of wallets holding balances between 1,000 and 10,000 BTC over the last six days.

- Sentiment Analysis: Bitcoin's Weighted Sentiment chart indicates a bearish sentiment, despite the optimistic developments in the market.

In conclusion, while Bitcoin faces some bearish sentiment, various factors such as the upcoming halving, introduction of spot ETFs, and bullish technical indicators suggest the potential for a bull rally. However, market sentiment remains uncertain, and investors should conduct their own research before making any trading decisions.

Oobit Raises $25 Million to Expand Crypto Payment Accessibility

- Oobit's Funding Round:

- Oobit, a mobile payment platform based in Singapore, secured $25 million in a Series A funding round.

- Tether's CMCC Global's Titan Fund led the investment, with 468 Capital and Solana’s co-founder Anatoly Yakovenko also contributing significantly.

- The funding signifies Oobit's substantial growth potential in the cryptocurrency market.

- Enhanced Crypto Payment Features:

- Oobit facilitates cryptocurrency shopping and conversion to fiat currency.

- Its tap and pay feature enables transactions via Visa and MasterCard-compatible points of sale, enhancing crypto wallet accessibility.

- Oobit plans to integrate with third-party wallets to broaden digital finance options for users.

- Future Partnerships and Collaborations:

- Oobit is set to announce partnerships shortly, signaling an ambitious agenda for growth.

- By collaborating with traditional financial institutions, Oobit aims to streamline crypto asset transactions.

- CEO Amram Adar emphasizes the significance of industry support and commits to simplifying digital asset payments through Oobit's strategy.

This highlights Oobit's proactive stance in evolving the cryptocurrency payments landscape through strategic partnerships and user-focused features.

Crypto Trends Grab Global Attention

- Nayib Bukele’s Reelection in El Salvador: Nayib Bukele's reelection as the president of El Salvador has garnered significant attention within the crypto community. Bukele has been a vocal advocate for cryptocurrency adoption and played a pivotal role in El Salvador becoming the first country to adopt Bitcoin as legal tender. His reelection is seen as a positive development for the further integration of blockchain technology and digital assets within the country. However, concerns also exist regarding potential regulatory challenges and hurdles that may arise as El Salvador continues its crypto-friendly initiatives.

- Jerome Powell’s Concerns: Federal Reserve Chairman Jerome Powell's comments about the US government's unsustainable path have reverberated across financial markets, including the cryptocurrency space. Powell's concerns could impact investor sentiment and potentially influence the volatility of both traditional assets and cryptocurrencies. Some speculators view Powell's remarks as a confirmation of the bullish thesis for Bitcoin, suggesting that his statements could contribute to a potential uptrend in BTC prices.

- Farcaster’s Rising User Base: Farcaster, a decentralized finance (DeFi) platform, has witnessed a significant increase in its active user base, signaling growing interest in the platform among investors and enthusiasts. This uptick in user activity underscores the continued expansion of DeFi and the broader interest in decentralized financial solutions within the cryptocurrency ecosystem.