Bitcoin Price Model Predicts $45K ‘Phase’ in November

- Bitcoin's Price Prediction: CryptoCon suggests that Bitcoin, which is currently trading at $34,456, could reach $45,000 in November. This prediction is based on a traditional Bitcoin price cycle and the use of Fibonacci retracement levels.

- Upside Potential: Despite Bitcoin reaching 17-month highs, CryptoCon believes there is still room for significant upside potential. By comparing Bitcoin's current price behavior to past cycles, the analyst suggests that BTC/USD could reach the highest target of the Fibonacci model before hitting a mid-cycle top. Four of these targets have already been reached, with the fourth one being just 3.3% above the recent high at $36,368.

- Timing: According to CryptoCon, the move to the cycle mid-top typically takes around 2 months after the end of a specific phase. Since the first month of phase 4 is about to conclude, the mid-top could potentially be achieved as soon as November.

- Resistance Levels: CryptoCon highlights two significant resistance levels at around $36,400 that Bitcoin bulls need to surpass to reach the $45,000 target.

- Different Setup in 2023: Another analyst, Rekt Capital, points out that Bitcoin's setup in 2023 is different from previous cycles. Typically, at this stage in its four-year pattern, Bitcoin should be testing support, not resistance. Rekt Capital suggests that a substantial pullback in Bitcoin could provide a significant buying opportunity within the ongoing cycle.

The analysis and predictions made by CryptoCon, a popular analyst.

It's essential to remember that cryptocurrency markets are highly volatile, and price predictions are subject to change. These analyses are based on historical patterns and indicators, but they do not guarantee future outcomes. Always conduct your research and consider your risk tolerance when making investment decisions. The information provided in the article is for informational purposes and should not be taken as financial advice.

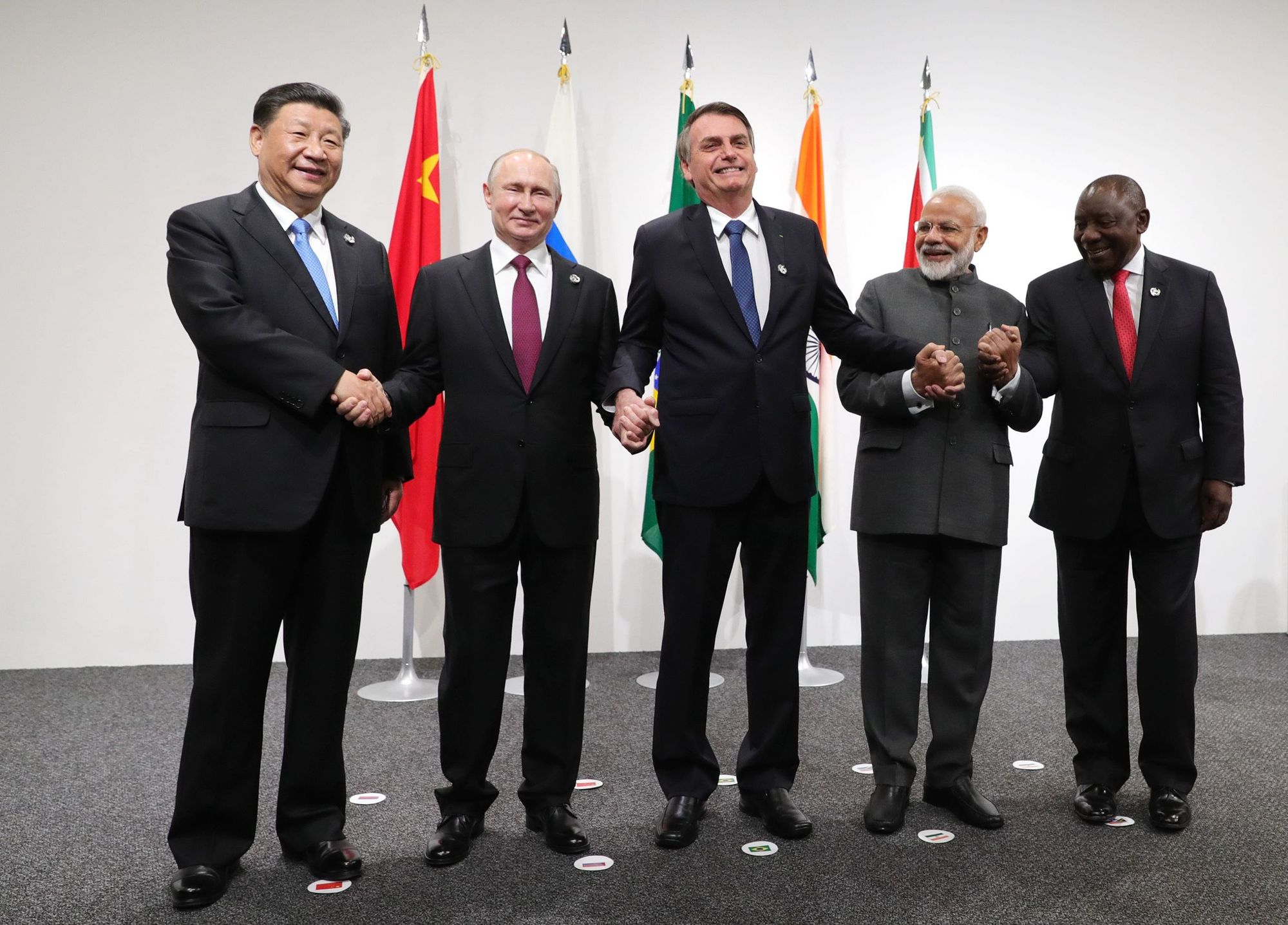

BRICS: Global Power Dynamics Shifting From the West

Dynamics are changing in the global financial ecosystem and the rise of the BRICS alliance will be a significant competitor to the traditional economic powers, including the G7 countries, especially the United States.

- BRICS vs. G7: The United States, the United Kingdom, and Germany, among other G7 countries, have historically held a dominant position in the global financial ecosystem, controlling various sectors, including banking, institutions, and policies. However, this year, the BRICS alliance has emerged as a formidable competitor, challenging the status quo.

- Ending US Dollar Reliance: BRICS aims to reduce reliance on the US dollar as the world's reserve currency. The alliance is promoting the use of local currencies instead of the US dollar and seeks to provide no means to fund the US deficit.

- Impact on the US: The article mentions that the shift away from the US dollar could have significant implications for various sectors in the United States. It's suggested that developing countries are looking to seize power from traditional developed nations.

- Shifting Global Power Dynamics: A panel of Foreign Institutional Investors (FII) has acknowledged that BRICS is indeed altering the global power dynamics, with a focus on the rising influence of BRICS and the challenges that the US and Western allies may face.

- Transition in the Global Economy: Eric Li, chairman and managing partner of Chinese venture capital firm Chengwei Capital, emphasized that the global economy is going through a transition. He highlighted the potential of the Global South, including BRICS countries, to reshape global finances and pose a competitive threat to the traditional economic centers.

- Potential Value Creation: Christine Tsai, CEO of early-stage venture fund 500 Global, mentioned that there is the potential for significant value creation coming from rising economies, particularly in Asia. This transition may impact global economic dynamics and competition.

It's important to note that such transitions in the global financial landscape are complex and often subject to geopolitical, economic, and policy developments. The article provides an overview of the changing dynamics but should not be considered as financial or investment advice.

A Historic Low in Staking Yields

A historic low in the average staking yield of the top 35 stakable cryptocurrencies during the third quarter, primarily due to an increase in the average stake rate among investors.

- Historic Low in Staking Yield: The average staking yield for the top 35 stakable cryptocurrencies reached a historic low during the third quarter. This decline in yield is attributed to the significant increase in the stake rate across proof-of-stake (PoS) networks, which reached 52.4%. As a result, the average staking yield dropped to 10.2%, the lowest ever recorded.

- Ethereum's Yield: Ethereum (ETH), the largest PoS network, saw its Consensus layer yield drop to a low of 3.2% during the third quarter. This decrease was accompanied by a record high percentage of total supply staked assets, reaching 22%. The Execution layer yield of ETH also dropped to 1.3%.

- Shift in Activity: The article notes that transaction activity shifted from Ethereum's Mainnet (Layer 1) to various Ethereum Layer 2 networks, contributing to the decline in staking yield for Ethereum.

- Deposits and Regulatory Scrutiny: While Ethereum staking saw a surge, overall staking deposit activity significantly slowed during the third quarter. The article also mentions that staking activities have come under increased regulatory scrutiny in the U.S., with the SEC categorizing them as securities.

- Implications for Investors: The decline in staking rewards has been ongoing since it peaked in March of the previous year. Only a couple of PoS networks, Polkadot and Cosmos, currently offer yields higher than 7.5%. This trend could have significant implications for both individual investors and the broader cryptocurrency market.

Staking involves holding and locking a specific amount of cryptocurrency to support the operations of a blockchain network, and in return, stakers receive rewards. It's a way for investors to earn passive income from their digital assets. However, as noted, regulatory scrutiny has increased in this space, which may impact how staking is conducted and regulated in the future.