Bitcoin's Surge Is Not Great For DeFi Sector, Coinbase Crash & $100M Program to Boost AI

Stagnation in DeFi Protocols Offering Exposure to U.S. Treasuries:

1. Overview:

- Growth in protocols providing exposure to tokenized U.S. treasuries has stagnated in decentralized finance (DeFi) despite previous success.

- These tokenized assets were considered a safe investment option within the traditional market, accessible to DeFi users through on-chain assets.

2. Impact of Bitcoin's Rise:

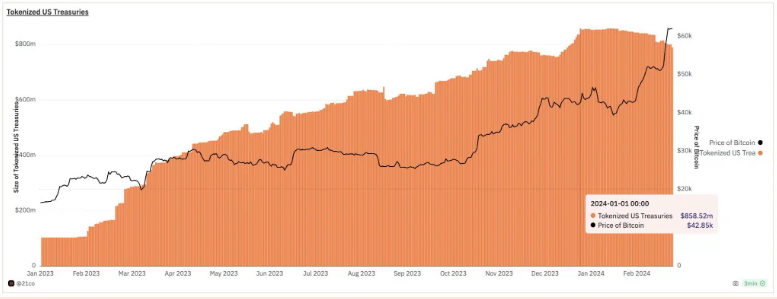

- On-chain analyst Tom Wan noted a negative correlation between investments in tokenized treasuries and the price of Bitcoin.

- As Bitcoin surged from $38k to $64k, the size of the on-chain treasury market shrank, indicating investor preference for riskier investments.

3. Decline in Growth Curve:

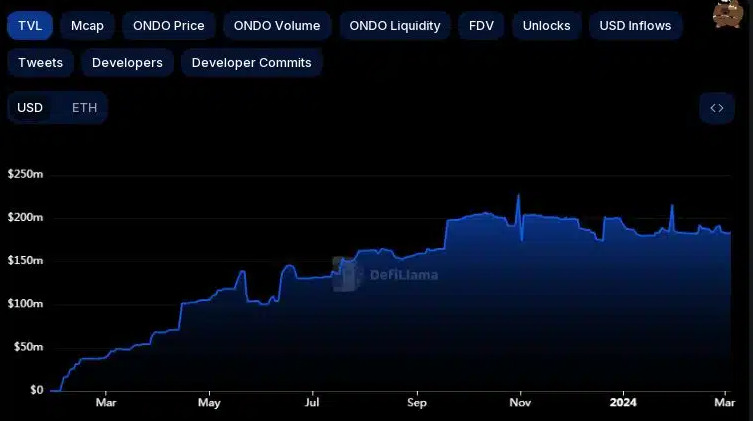

- Protocols offering exposure to U.S. treasuries, like Ondo Finance and Mountain Protocol, experienced stagnation in Total Value Locked (TVL).

- Monthly drops in TVL were observed, with Ondo Finance and Mountain Protocol recording drops of 0.1% and 0.26% respectively.

4. Shift in Investor Interest:

- Investor appetite for tokenized treasuries waned as attention shifted towards higher returns in the crypto market, away from stable 5% yields.

- Anticipations of the Fed cutting interest rates further dampened interest in tokenized treasuries.

5. Recommendations for Builders:

- Tom Han advises builders of these projects to focus on adoption and integration rather than expanding product offerings.

- Integrating these products into layer-1 and layer-2 networks is suggested to boost adoption, considering regulatory risks associated with tokenization.

6. Conclusion:

- Despite initial success, the stagnation in growth of DeFi protocols offering exposure to U.S. treasuries reflects a shift in investor preferences towards higher-yield opportunities in the crypto market and regulatory uncertainties surrounding tokenization.

Coinbase Crashed Again As Bitcoin Surge

Coinbase Faces Technical Issues Amid Bitcoin Price Fluctuations:

1. Technical Problems Amid Bitcoin Price Volatility:

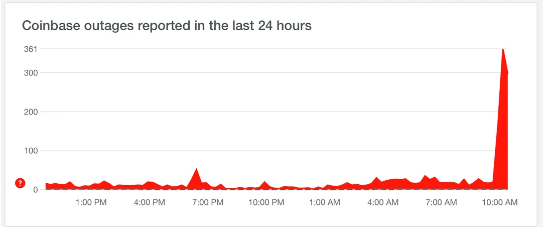

- Coinbase, a prominent U.S. crypto exchange, reported technical issues just minutes after resolving prior problems.

- The disclosure of errors coincided with a surge and subsequent collapse in the price of Bitcoin, drawing significant interest from retail investors.

2. Response from Coinbase:

- In response to inquiries about system stability, a Coinbase spokesperson highlighted the company's mission to increase economic freedom and efforts to enhance system capacity and resilience.

3. Previous Availability Issues:

- Coinbase had previously reported availability issues overnight, with intermittent errors in trading, deposits, and withdrawals across Coinbase.com.

- Users were advised to retry transactions in case of failures.

4. Outage Tracked by Downdetector:

- The latest outage was tracked by third-party monitoring service Downdetector, with user reports of a Coinbase outage spiking simultaneously with Coinbase's status update.

5. Impact on Bitcoin Price and Market Perception:

- Crypto Twitter users noted a "flash crash" in the price of Bitcoin localized to the Coinbase platform, with the price dropping from an all-time high to as low as $59,224 within five hours.

- Coinbase's struggles during Bitcoin rallies are considered by many as indicative of an official Bitcoin bull run.

6. Comparison with Competitors:

- While incidents during crypto storms are not uncommon, widespread system outages like those reported by Coinbase are less typical.

- Competing exchanges like Kraken and Binance also report incidents during crypto storms but are limited to specific networks or crypto pairings.

7. User Base and Stock Performance:

- Coinbase has an estimated 110 million monthly active users, slightly fewer than Binance's estimated 128 million monthly active users, and significantly more than Kraken's 9 million monthly active users.

- The price of Coinbase stock (NASDAQ: COIN) has experienced a similar rise-and-fall trajectory, climbing 80% over the past month but falling 6% over the past 24 hours at the time of writing.

Fetch AI Unveils $100M Program to Boost AI Development

But FET Price Dipped by 7.10%

1. Introduction of Fetch Compute:

- Fetch AI unveils Fetch Compute, a $100 million initiative aimed at enhancing AI development.

- The program seeks to provide advanced Nvidia GPUs to accelerate innovation within the Fetch.ai ecosystem.

2. Access to Advanced Nvidia GPUs:

- Fetch Compute introduces access to advanced Nvidia GPUs, including H200, H100, and A100, empowering developers and users with unprecedented computing resources.

- The primary objective is to expedite innovation within the Fetch AI ecosystem by deploying cutting-edge GPU technology.

3. Financing and Support:

- The financing for Fetch Compute will be drawn from the Fetch AI ecosystem fund, ensuring sustained support for the initiative's endeavors.

4. Rewards System for Users:

- Fetch AI introduces a rewards system within Fetch Compute, allowing users to earn Fetch Compute Credits by staking FET.

- These credits can offset GPU utilization costs on the Fetch Compute network, incentivizing user participation and engagement.

5. CEO's Enthusiasm:

- Humayun Sheikh, the CEO of Fetch AI, expresses enthusiasm about the transformative potential of FET Compute.

- The initiative aims to empower the community with necessary tools and support to realize visionary AI projects.

6. Market Response and Outlook:

- The announcement of FET Compute coincides with heightened interest in AI-related tokens, driven by Nvidia's impressive Q4 2024 earnings report.

- Despite a temporary dip in FET prices, the project remains poised for long-term success, supported by robust infrastructure and strategic alliances.