Cardano's Price Performance and AI-Powered Forecasts

Recent Trends and Recovery Signs

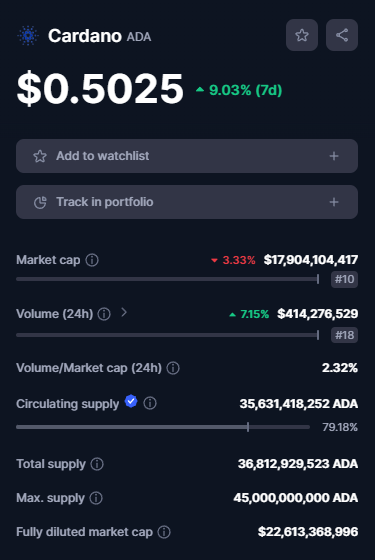

Recent trends in the cryptocurrency market have highlighted notable performance by Cardano (ADA), characterized by fluctuations in prices and optimistic predictions from AI models. Despite experiencing a challenging period where prices dropped to $0.4051, ADA managed to overcome significant resistance levels.

As April began, ADA saw its price fall from $0.60, subsequently dropping below support levels of $0.550 and $0.500. However, recent developments illustrate a reversal in this downtrend, with ADA not only rallying in recent days but also surpassing the critical $0.500 mark, indicating a potential reversal of the downward trend.

Optimistic Short-Term Price Predictions from AI

AI powered by CoinCodex suggests an optimistic short-term outlook for ADA. By May 23, 2024, the model predicts a 4.55% increase in ADA’s price, reaching approximately $0.534035. Additionally, a forecast for May 1, 2024, sets the price at $0.494680.

Technical Analysis Highlights

Throughout the past week, ADA displayed a clear upward trend against the USDT, showing robust buyer interest. This period saw prices rise from $0.444295 on April 17, 2024, to $0.509638 on April 23, 2024. Technical analysis identifies the week’s peak at $0.519864 as a resistance level, while support was found at $0.505011.

Points to Take into Account

- ADA’s price recovery above $0.500 indicates a strong support zone, reinforcing the bullish momentum.

- The AI predictions align with the general market conditions, suggesting a favorable outlook for ADA investors.

- Monitoring ADA’s ability to maintain closure above resistance levels could provide investment insights.

Conclusion

Overall, the technical analysis combined with AI forecasts provides a hopeful perspective for ADA’s future market performance, suggesting continued interest and a potential increase in price levels. Investors may find value in monitoring ADA’s behavior in the coming weeks to make informed investment decisions.

Binance Announces Long Awaited Feature

Binance Introduces Spot Copy Trading Tool

Binance, the world's leading cryptocurrency exchange, has announced the launch of a new spot copy trading tool, allowing users to automatically replicate trades from some of the platform's most successful traders.

According to Binance CTO Rohit Wad, the spot copy trading feature emerged from community feedback, reflecting the exchange's commitment to incorporating user suggestions into its products.

Similar concepts have been implemented by other major crypto exchanges like Bybit, OKX, and Bitget.

Key Features and Details:

- Binance's spot copy trading product is now open for registration for "lead traders" who meet minimum portfolio asset management size requirements.

- Lead traders' portfolios should range from 500 USDT to 250,000 USDT.

- Investors whose trades are copied will receive a weekly 10% profit share and a 10% trading commission refund.

- Users can review leading investors' metrics, including profit and loss records, and copy up to ten leading investor portfolios simultaneously.

- Users can set their own automatic risk controls, such as stop-loss and copying at a fixed rate or amount.

- Leverage will not be available for spot copy trading.

- Initially available in select markets in Latin America, Europe, the Middle East, and Asia Pacific, with over a hundred spot pairs at launch.

Expansion and Previous Initiatives:

- Binance previously introduced a copy trading feature for futures products in select regions in October 2023.

- Lead traders registered for the futures copy trading product must also register for spot copy trading.

Conclusion:

The introduction of Binance's spot copy trading tool underscores the exchange's commitment to providing innovative trading solutions and catering to the needs of its diverse user base. With features like automatic risk controls and profit sharing, this tool aims to simplify trading for users while offering opportunities for profitable investment strategies.

Akash Surges 48% on Upbit Listing

Akash Network's AKT Token Surges Following Upbit Listing

Today, Akash Network’s AKT token experienced significant gains, surpassing other leading cryptocurrencies, after its listing on Upbit, South Korea’s largest exchange.

In the past 24 hours alone, AKT surged by an impressive 48%, reaching $7.1 at the latest update. This surge in value reflects growing interest in Akash Network and its potential for further growth.

Market Cap and Trading Volume Surge:

Following the increase in AKT’s value, its total market capitalization rose substantially to $1.4 billion, positioning it as the 65th largest cryptocurrency by market size. Additionally, the daily trading volume for AKT witnessed an astounding surge of 1,560%, reaching $65 million.

Investors are closely monitoring these developments, indicating heightened interest in Akash Network and its potential in the cryptocurrency market.

Upbit Listing Drives Momentum:

Upbit commenced trading AKT at 10:00 UTC on April 23, offering AKT trading pairs with the Korean Won (KRW), Bitcoin (BTC), and Tether (USDT). This listing is a significant event, contributing to the increase in AKT’s price and attracting considerable interest among investors.

Social Media Buzz Surrounds Akash Network:

Akash Network is gaining traction on social media platforms, with activity around the project increasing by 200% in the last day. Platforms like Reddit and Bitcointalk are seeing discussions about Akash Network intensify.

AKT Price Still Below All-Time High:

Despite the recent surge, AKT remains 23% below its all-time high of $8.08, reached in April 2021. However, with Upbit listing the token and the subsequent rise in both price and social media activity, there’s optimism surrounding Akash Network’s outlook.

Investor Sentiment and Future Outlook:

Investors are closely monitoring these developments as indicators of AKT’s potential growth trajectory. The listing on Upbit, coupled with increased social media activity, suggests a positive outlook for Akash Network.

Former Twitter CEO Jack Dorsey, the Long Time Silent Bitcoin Bull, Finally Speaks Out: Makes BTC Announcement

Block, Owned by Jack Dorsey, Makes Strides in Bitcoin Mining

Block, the Bitcoin-focused company led by former Twitter CEO Jack Dorsey, has achieved significant progress in its BTC mining endeavors. The company has successfully developed a cutting-edge three-nanometer (nm) BTC mining chip, nearing the final stages of production at a prominent global semiconductor foundry.

In addition to chip development, Block has unveiled a comprehensive "Bitcoin mining system" designed to tackle industry challenges and foster mining decentralization.

Key Points:

- Advanced Chip Development: Block has made strides in chip development, with a focus on efficiency and performance. The three-nanometer BTC mining chip represents a significant technological advancement in the mining industry.

- Comprehensive Mining System: Block's initiative extends beyond chip development. The company aims to provide a holistic solution for mining operators, addressing various operational challenges and promoting decentralization.

- CEO's Commitment: Jack Dorsey reaffirmed Block's dedication to the mining project, emphasizing the company's efforts to build a robust mining rig. Dorsey's involvement underscores his commitment to Bitcoin development following his departure from Twitter.

- Prototype Success: Block had previously developed a prototype of a five-nanometer mining chip, which received positive feedback from partners. Building on this success, the company has now focused on refining its three-nanometer chip design for BTC mining.

- Full-Scale Mining System: Dorsey highlighted Block's achievement in developing a comprehensive mining system, indicating the company's readiness to deploy its mining infrastructure.

- Dorsey's Transition: Following his resignation as Twitter CEO, Dorsey has shifted his focus to Bitcoin-related initiatives, showcasing his ongoing commitment to the cryptocurrency space.

Conclusion:

Block's progress in BTC mining chip development and the creation of a comprehensive mining system reflects its commitment to advancing Bitcoin infrastructure. With Dorsey's leadership and the company's technological expertise, Block aims to play a significant role in shaping the future of Bitcoin mining, driving decentralization and innovation in the industry.