Crypto Stocks to Watch

Nvidia's Influence on Crypto Stocks

Nvidia, the AI chip maker, has seen its stock soar 5.24%, hitting an all-time high of $1,120.49. This rise has positively impacted tech and crypto stocks. Nvidia's Q1 2024 earnings showed revenues of $26 billion, sparking renewed interest in AI coins and crypto stocks.

Crypto Stocks to Watch

Coinbase (COIN)

- Performance: Up 1.87% today; 4% increase over the last seven days.

- Year-to-Date (YTD): Increased by 54.3% after a positive Q1 result.

- Factors: Benefiting from Bitcoin’s price surge above $73,000, boosting market activities.

Marathon Digital (MARA)

- Performance: Down 2% today but up 14% this month; 67% growth over the last six months.

- Factors: Bitcoin mining firm repositioning reserves before the halving event, influencing market inflows.

Bitfarms (BITF)

- Performance: Up 3.5% today; 17% increase over the last five days.

- YTD Performance: Mixed, with losses earlier in the year but recent positive market performance.

- Factors: Rejected a merger with Riot Platforms, maintaining its independence and potential for growth.

Conclusion

Nvidia’s impressive performance has led to increased interest in crypto stocks. Coinbase, Marathon Digital, and Bitfarms are notable stocks to watch, each benefiting from the broader market's positive sentiment and specific developments within the crypto space.

Surge in Bitcoin Investment Products

Significant Inflows

Bitcoin investment products experienced significant inflows, exceeding $1 billion last week, pushing the yearly total to around $14.6 billion. The surge, driven by institutional and long-term investors, saw notable inflows of $1.01 billion into Bitcoin exchange-traded products in the week ending May 24.

Factors Driving Increased Interest

Record-Breaking Inflows

Total inflows into cryptocurrency investment products reached $1.05 billion, breaking the 2024 record of $14.9 billion. CoinShares' Weekly Crypto Asset Fund Flows report, released on May 28, highlighted a 28% rise in weekly trading volumes, reaching $13.6 billion. Currently, crypto funds manage assets worth $98.43 billion.

Market Expectations

The increase in buying and price surges is primarily due to market expectations of US approval for spot Ethereum ETF funds. Despite Ethereum’s underperformance post-approval, the sustained inflows into spot Bitcoin ETF funds remain significant.

Institutional Investments

Investment Data

Data from Farside Investors shows institutions poured around $1.057 billion into spot Bitcoin ETF funds between May 20 and May 24. Grayscale’s IBIT witnessed a significant drop in outflows to just $20.5 million per week, indicating strong institutional interest and confidence in Bitcoin as an investment asset.

Key Insights for Investors

- Increased Institutional Investment: Significant growth in institutional investments in Bitcoin ETF funds.

- Ethereum ETF Influence: Approval of spot Ethereum ETF funds in the US positively influencing Bitcoin ETF inflows.

- Rising Trading Volumes: Cryptocurrency fund trading volumes have seen a 28% rise recently.

- Reduced Grayscale IBIT Outflows: A dramatic reduction in Grayscale’s IBIT outflows, signaling a potential market shift.

Future Expectations for Bitcoin

Analyst Predictions

- Price Action Range: Popular analyst Daan Crypto Trades notes Bitcoin’s 8-hour chart shows a price action range between $59,095 and an all-time high of $73,800. Minor deviations below this range were quickly corrected, indicating a stable movement pattern.

- Consolidation Prediction: Analyst Rekt Capital highlights Bitcoin’s recent climb above $70,000, marking a new local peak. He predicts Bitcoin will continue to consolidate between $60,000 and $70,000, suggesting a stable yet range-bound movement in the near future.

Upgrade Your Trading Skills with Unicapital’s AI

The Unicapital Advantage

Empowering Traders with Innovation Unicapital combines security, customization, and advanced technology to offer a robust trading platform suitable for all traders, from beginners to professionals. Leveraging AI and machine learning, it minimizes risk and enhances decision-making, allowing users to navigate market complexities confidently.

Unique Blend of Technology and Expertise

Symbiotic Integration Unicapital distinguishes itself by merging advanced technology with human expertise. This integration ensures users benefit from a comprehensive and insightful trading approach. Continuous feature and security updates keep users ahead in trading technology, highlighting Unicapital’s commitment to user success.

Culture of Collaboration

Innovation, Integrity, and Inclusivity Unicapital fosters an environment where innovation thrives, and challenges are met with creative solutions. The platform values its users as the most valuable asset, providing in-depth market analysis and personalized strategies to support their trading endeavors.

Strategic Partnerships

Expanding Capabilities Unicapital collaborates with leading service providers in the digital assets landscape, ensuring users have access to advanced and reliable trading tools. These partnerships enhance service offerings, providing real-time market data and sophisticated analytical instruments for a seamless trading experience.

Gateway to Future Trading

Comprehensive Trading Solution By choosing Unicapital, users gain access to a comprehensive trading solution designed to propel them towards success in global markets. The platform’s dedication to technology and client support solidifies its position as an innovator in the digital assets trading industry.

About Unicapital

Platform Overview Unicapital is a multi-faceted platform that equips users with the knowledge and tools to explore global digital asset markets efficiently. Offering AI-driven solutions and in-depth learning resources, Unicapital enables users to tailor their trading journey to meet their personal goals.

Will Mog Coin Continue to It's Insane Rise?

Mog Coin Price Analysis

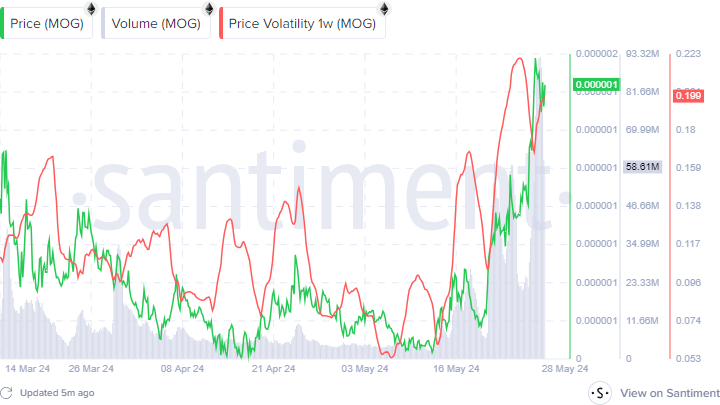

Current Price and Performance

- All-Time High: $0.000001650 (closing at $0.000001500 on May 27, 2024)

Recent Gains and Price Structure

Breakout and Gains

- Weekly Performance: 80% gains

- Monthly Performance: 115% gains

- EMA Position: Price above 50-day and 200-day EMAs after breakout

Potential for Decline

Signs of Weakness

- Current Weakness: Price dropped from key supply level of $0.000001500

- Support Level: Critical support at $0.000001300

- Bearish Indicators: RSI at 69.21, declining from overbought territory

Bearish Scenario

- Support Level Breach: If MOG fails to sustain above $0.000001300, bears may take control

- Oscillator Signals: Bearish signs from oscillators suggest potential further decline

Volatility and Resistance

Volume and Volatility

- Volume Spike: Increased from $4.0 Million to $71.65 Million

- Volatility Increase: Alongside price rise, indicating instability

Resistance Factors

- Supply Level Resistance: Despite buying pressure, sellers gaining strength

- Potential for Decline: Bears may dominate and push price down

Future Outlook

Bullish Scenario

- Demand Persistence: If demand remains high, MOG could rally upwards

- Next Target: Potential to reach $0.000002000

Summary Mog Coin is currently trading at $0.00000140 after a significant intraday decline. Despite remarkable recent gains and positive EMA indicators, there are signs of weakness and potential for a significant drop if it fails to sustain above a crucial support level. Increased volume and volatility suggest instability, and resistance at the supply level indicates possible bearish dominance. However, sustained demand could see the price rally to new highs.

Tangem Wallet Something for You?

Tangem Wallet Review: A Comprehensive Analysis

Overview of Tangem Wallet

- Innovative Hardware Wallet: Tangem Wallet utilizes smart card technology for secure cryptocurrency storage.

- User-Friendly Approach: Simplifies user experience, making it accessible to beginners.

Key Features

- Smart Card Technology: Utilizes secure chips similar to those in credit cards, ensuring top-tier security.

- Ease of Use: Simple setup process and intuitive transactions via NFC technology.

- Decentralized Operation: Operates independently without reliance on central servers, enhancing security.

- Multi-Currency Support: Versatile support for various cryptocurrencies, including Bitcoin and Ethereum.

Major Strengths

- Design and Build Quality: Portable, water-resistant, and aesthetically pleasing design.

- Setup and Initialization: Quick and straightforward setup process via mobile app.

- User Experience: Smooth and intuitive interface for seamless transactions.

- Robust Security: Tamper-proof chip and private key protection ensure top-tier security.

- Multi-Currency Support: Supports diverse portfolios with ease.

Potential Drawbacks

- Limited Functionality: Lacks some advanced features like staking or direct cryptocurrency exchange.

- Dependency on NFC: Relies on NFC-enabled devices for transactions, limiting usability for some users.

- Physical Damage Risks: Susceptible to physical damage if mishandled.

Comparison with Other Hardware Wallets

- Simplicity vs. Advanced Features: Tangem excels in simplicity but may lack advanced features compared to traditional hardware wallets.

- Innovative Approach: Tangem's tap-and-go method sets it apart from competitors.

Future Developments and Roadmap

- Continued Improvement: Tangem aims to enhance security, add support for more cryptocurrencies, and cater to advanced users.

Conclusion

- Innovative Solution: Tangem Wallet offers a unique blend of security and simplicity, making it suitable for both beginners and experienced users.

- Compelling Choice: Secure, portable, and user-friendly, Tangem Wallet is a compelling option for cryptocurrency storage.

- Potential for Growth: As Tangem evolves, it has the potential to become a leader in the hardware wallet market.