Experts Say Bitcoin's Post Halving Price Will Look Like This [+1 BONUS POST]

![Experts Say Bitcoin's Post Halving Price Will Look Like This [+1 BONUS POST]](/content/images/size/w960/2024/04/bitcoin-halving-pink-bg.webp)

Introduction

The current Bitcoin market cycle is notable for hitting a new all-time high before the halving event, contrary to previous cycles where the ATH occurred post-halving. This raises questions about whether the Bitcoin halving has already been factored into the market.

Fred Thiel's Perspective

Fred Thiel, CEO of Marathon Digital, believes that the current BTC price has partially priced in the halving. He attributes this to the success of new spot BTC ETFs, which have attracted capital into the market and accelerated potential price appreciation that would typically occur 3 to 6 months post-halving. Thiel expects minimal impact on BTC price post-halving due to the reduction in Bitcoin supply.

Riot Platforms' View

Riot Platforms, another Bitcoin miner, holds a bullish outlook post-halving. Jason Les, their CIO, foresees a bullish scenario for long-term price appreciation after the 2024 halving.

Kris Marszalek's Observations

Kris Marszalek, CEO of Crypto.com, observes that the current BTC price action mirrors the previous cycle's consolidation phase. He anticipates significant market action in the six months following the halving. However, Marszalek warns of potential selling ahead of the halving and notes the impact of retail investor activity on market dynamics.

Conclusion

Despite differing perspectives among industry insiders, the question of whether Bitcoin will experience significant traction post-halving remains uncertain. Factors such as ETF success, miner sentiment, and retail investor behavior contribute to the ongoing speculation about Bitcoin's future price movements.

Elon Takes Direct Shots At ChatGPT and Gemini

Elon Musk's Critique of ChatGPT and Gemini

Elon Musk indirectly criticized OpenAI's ChatGPT and Google's Gemini for their potential to propagate subjective truth, which he believes could be detrimental to civilization. Musk expressed concern that such programming in powerful AI tools could have disastrous consequences.

Context: Subjectivity of Truth

The discussion originated from a TED talk by NPR CEO Katherine Maher, highlighting the subjective nature of truth. Professor Gaad Saad criticized this notion, associating it with postmodernism and referring to it as a "parasitic idea pathogen."

Musk's Displeasure and Promotion of Grok AI

Musk's comments align with his belief in a singular truth, contrasting with the subjective interpretation of truth. He subtly suggested that platforms like ChatGPT and Gemini already embody this subjective truth programming. Musk's critique could also serve as promotion for Grok AI, his own chatbot project, positioning it as an alternative.

Grok AI's Capabilities and Enhancement

Grok AI has showcased proficiency in various tasks, including identifying airdrops, explaining complex protocols, and crafting social media content. Musk recently launched an updated version, Grok 1.5, with enhanced capabilities to process visual data, particularly aimed at improving understanding of real-life images through the RealWorldQA module.

Hong Kong Crypto ETFs Target $1 Billion

Bloomberg Analysts Predict $1 Billion AUM for Bitcoin and Ethereum ETFs in Hong Kong

Analysts at Bloomberg have revised their estimates for the size of Assets Under Management (AUM) for Bitcoin and Ethereum Exchange-Traded Funds (ETFs) in Hong Kong, projecting it to reach no less than $1 billion within the next two years. This marks a significant increase from their previous prediction of $500 million.

Challenges Faced by Investors

Despite the optimistic outlook, there are challenges for investors in the region. Mainland China's stringent regulations on cryptocurrencies make it difficult for participants to engage in trading. Mainland investors may not be eligible to buy Hong Kong-listed spot bitcoin and ether ETFs due to restrictions on purchasing virtual assets. Alternative routes exist, but they are less utilized and could potentially face shutdowns.

Milestone Achievement and Infrastructure Upgrades

Achieving the milestone of $1 billion AUM hinges on upgrades to Hong Kong's financial infrastructure, particularly concerning crypto assets. Currently, the total AUM of Bitcoin ETFs in the region stands at $250 million. This development has spurred major firms like ChinaAMC to pursue spot ETFs, which is expected to drive significant growth in Hong Kong's crypto ETF market.

OMNI crashes 44% less than 12 hours after its airdrop

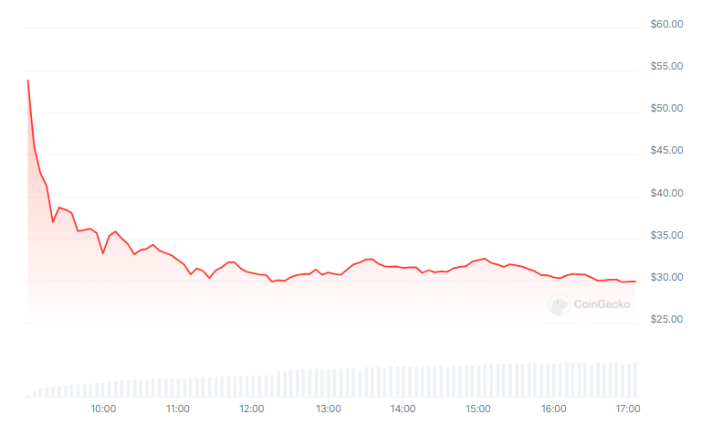

Omni Network Launches OMNI Token, Experiences 44% Price Crash

Rollup interoperability infrastructure Omni Network introduced its native OMNI token recently, but the token's price plummeted by 44% shortly after its launch, according to data from CoinGecko. As of now, OMNI is priced at $30.03, with a fully diluted valuation exceeding $3 billion and a market cap of $318 million. In the last 24 hours, OMNI's trading volume reached nearly $447 million.

Potential Market Dynamics at Play

The significant price drop of OMNI may not necessarily reflect its intrinsic value but could be attributed to broader market movements. Bitcoin (BTC) experienced a decline of over 12% in the past week, briefly dipping below the $60,000 mark on certain centralized exchanges. This downward trend in Bitcoin's price influenced a pullback in other tokens as well. Consequently, investors perceived new buying opportunities in major cryptocurrencies, leading them to sell or rotate their capital into these assets.

Impact on Airdropped Tokens

As OMNI is an airdropped token, investors view it as a source of new liquidity, prompting some to sell and reallocate their funds into more established coins. Similarly, PRCL, the airdropped token for the real-world asset-based derivatives exchange Parcl, experienced a decline of 25% and bottomed out at $0.4658.

Potential for Recovery

While not guaranteed, there is potential for both OMNI and PRCL to recover in the coming days. This recovery may occur once the market completes its accumulation phase for other tokens. Rekt Capital, a trader, indicated that a pre-halving retracement is underway, a pattern observed in previous halving cycles. Following this phase, an accumulation period typically follows, eventually leading to a parabolic uptrend initiated by Bitcoin.

CHECK OUT THIS WEEKS PRICE PREDICTIONS