Is Altcoin Season Over or Just Starting?

Current Market Overview

Bitcoin Stability vs. Altcoin Decline

- Bitcoin: Maintaining steady position, trading below $66K.

- Altcoins: Significant declines, wiping out March gains.

Market Sentiment

Pessimistic Outlook

- Diminished demand for an upcoming cryptocurrency season.

- Two main bearish factors: Ethereum's 5% decline over the past week and delayed listing of Ethereum ETFs.

Ethereum ETFs and Market Impact

Delay and Confusion

- Postponement of Ethereum ETF listing causing market instability.

- Bloomberg analysts predict possible increase with ETF debut on July 2, potentially reclassifying Ethereum as a commodity.

Macroeconomic Influences

Federal Reserve and Interest Rates

- Elevated inflation and unfavorable U.S. economic data preventing the Fed from lowering interest rates.

- Altcoins perform well during quantitative easing and low-interest rates due to surplus global liquidity.

- Current conditions of high interest rates and constrained funds negatively impact high-risk assets like cryptocurrencies.

Bitcoin Dominance

Dominance and Pressure on Altcoins

- Bitcoin's market dominance at 55.4%, indicating increased pressure on altcoins.

Future Speculations

Potential Reversal with Ethereum ETF

- Analysts speculate that the introduction of the Ethereum ETF could reverse the current trend, drawing more investor attention to altcoins.

Australia Launches It's First Bitcoin ETF

Approval of Australia's First Spot Bitcoin ETF

VanEck Bitcoin ETF (VBTC) on ASX

- Approval: The Australian Securities Exchange (ASX) has approved the listing of Australia's first spot Bitcoin ETF, the VanEck Bitcoin ETF (VBTC).

- Context: This approval follows the success of Bitcoin ETFs in the U.S. and Hong Kong, indicating a global trend towards these investment products.

Global Bitcoin ETF Trends

Success in Other Markets

- U.S. and Hong Kong: Both markets have seen notable success with Bitcoin ETFs, with 11 spot Bitcoin ETFs listed in the U.S. in January.

- Growing Demand: This success has led to increased interest and demand for Bitcoin ETFs globally, including in Australia.

Australian Market Demand

Previous Bitcoin ETFs and Increased Visibility

- Existing ETFs: Australia had previously launched the Global X 21 Shares Bitcoin ETF (EBTC) and the Monochrome Bitcoin ETF (IBTC).

- Impact of VBTC: Listing the VBTC on ASX adds visibility and credibility, attracting a broader range of investors.

- Demand Insights: Arian Neiron, CEO of VanEck Asia Pacific, notes the growing demand for Bitcoin investment options in Australia.

Global Crypto Investment Trends

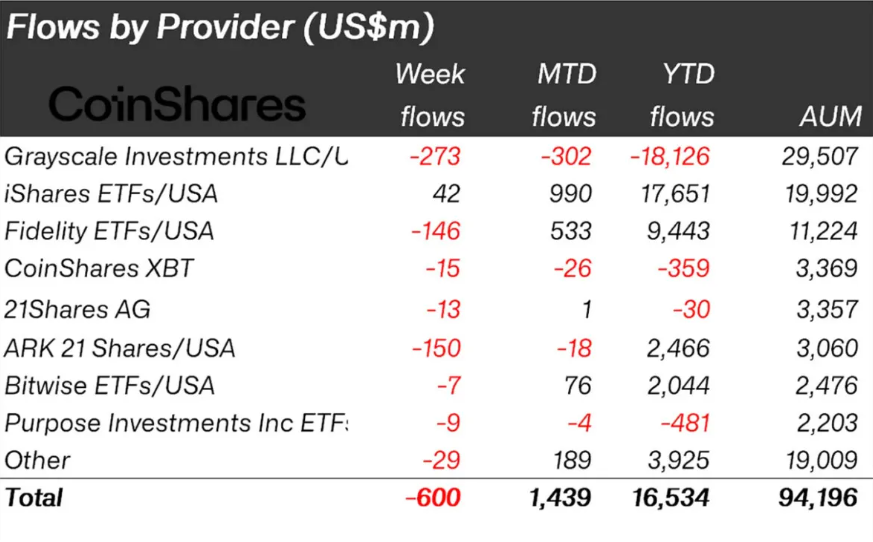

Significant Outflows in Digital Assets

- Recent Data: CoinShares reports significant outflows in digital asset investment products, with $621 million outflows in Bitcoin last week.

- Market Reaction: These outflows follow a hawkish Federal Open Market Committee (FOMC) meeting, leading investors to reduce exposure to fixed-supply assets.

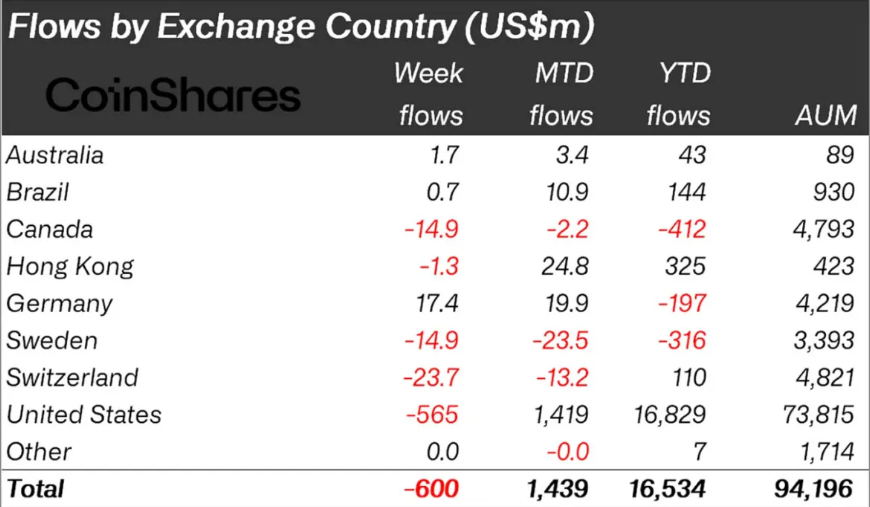

Regional Investment Trends

Outflows and Inflows by Region

- U.S. Outflows: The U.S. saw the majority of the outflows, totaling $565 million.

- Other Regions: Canada, Switzerland, and Sweden also experienced outflows. In contrast, Germany saw $17 million in inflows, showing a positive outlook.

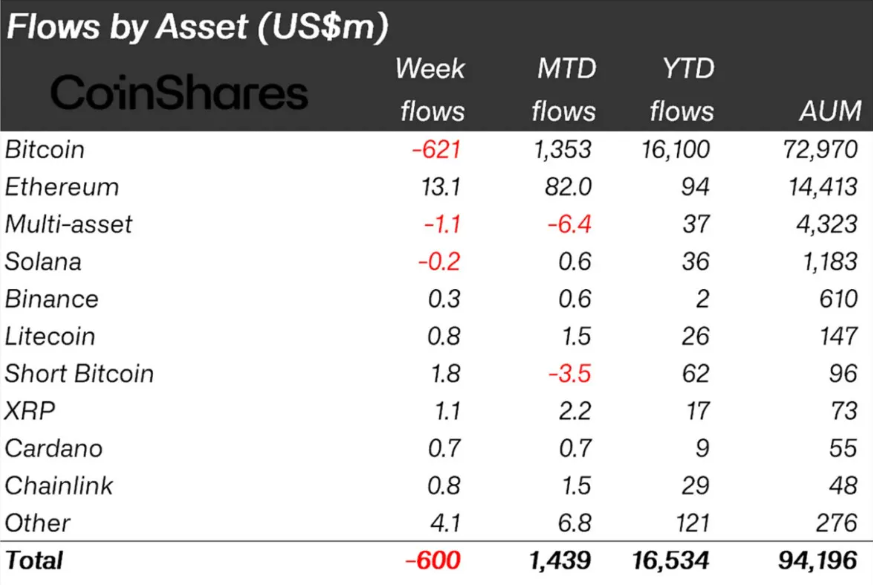

Bitcoin vs. Altcoins

Investor Sentiment

- Bitcoin Focus: Despite the bearish sentiment around Bitcoin, altcoins like Ethereum, LIDO, and XRP attracted positive inflows.

- Short-Bitcoin Positions: There were $1.8 million in inflows into short-Bitcoin positions, indicating bets on further price declines for Bitcoin.

Summary

The ASX's approval of the VanEck Bitcoin ETF reflects the growing demand for Bitcoin investment vehicles in Australia, mirroring global trends seen in the U.S. and Hong Kong. Despite significant outflows in digital assets, particularly Bitcoin, there is still substantial interest in other cryptocurrencies, suggesting a nuanced investor sentiment in the crypto market.

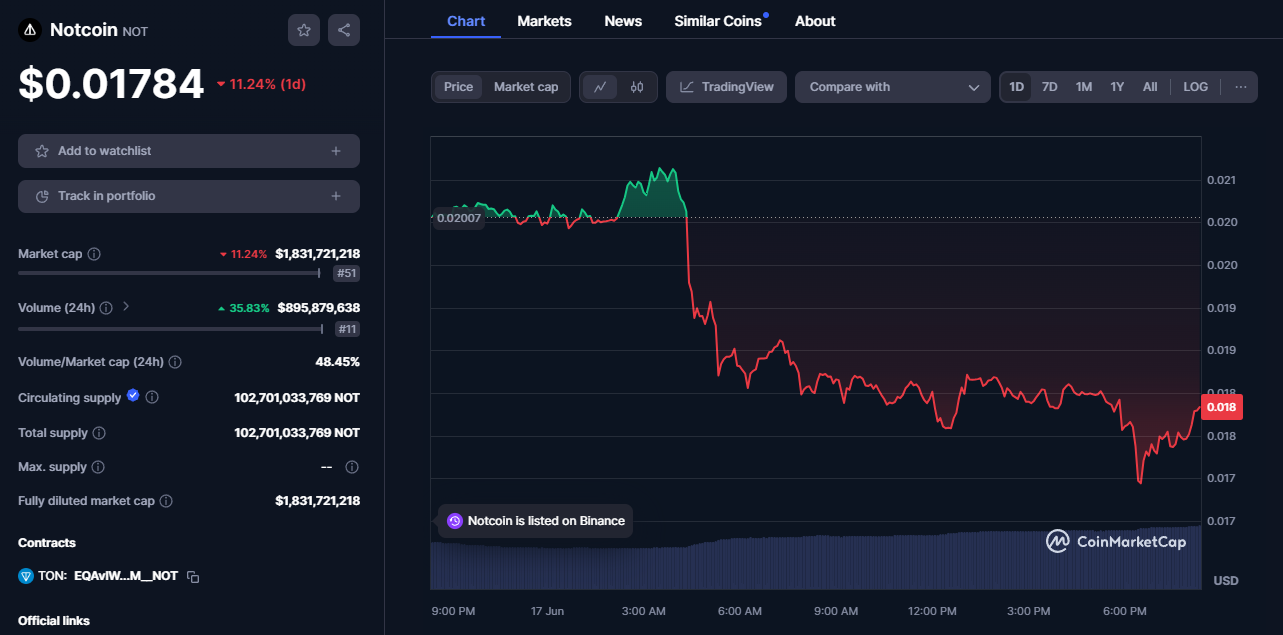

Notcoin Drops Over 15% In Price

Recent Price Decline

Since the end of the latest airdrop claim period on Sunday, Notcoin (NOT) has experienced a significant decrease of 18.3%, dropping from $0.02071 to $0.0175. As of now, the price of Notcoin has slightly recovered to $0.01804, with a total market capitalization of $1.85 billion.

Trade Volume and Market Correction

Over the past 24 hours, Notcoin's trade volume has fallen by more than 20%, totaling $899 million. This decline coincides with a broader market correction, with Notcoin's current price being more than 37% below its all-time high of $0.02896.

Market Position

Despite the decline, Notcoin remains the 57th largest cryptocurrency by market capitalization. It continues to outperform notable projects such as Jupiter and zkSync in terms of market buzz.

User Base and Adoption

Notcoin boasts a large user base with 11.5 million holders, including at least 2.5 million confirmed on-chain participants. This substantial user base persists despite the recent negative growth.

Development and Origin

Notcoin is a partially developed cryptocurrency based on the TON blockchain. It gained initial popularity through an airdrop distributed to users of a popular Telegram-based tap-to-earn game. The game's success has significantly contributed to Notcoin's rapid acceptance and positive attention within the crypto community.

CHECK OUT THIS WEEKS PRICE PREDICTIONS!