Price analysis 11/6: BTC, ETH SPX, DXY, BNB, XRP, SOL, ADA, DOGE, TON [FREE ANALYSIS]

![Price analysis 11/6: BTC, ETH SPX, DXY, BNB, XRP, SOL, ADA, DOGE, TON [FREE ANALYSIS]](/content/images/size/w960/2023/11/bic_Top_5_Aspiring_Coins_ETH.jpg.optimal.jpg)

Analysis made by Cointelegraph

- Bitcoin (BTC):

- Currently priced at $34,977.

- It has experienced a marginal rise of about 1.5% last week, suggesting cautious trading at higher levels.

- Positive sentiment among traders due to increased Bitcoin withdrawals from exchanges.

- Accumulation is taking place in anticipation of approval for a spot Bitcoin exchange-traded fund.

- The next major obstacle for BTC is at $40,000 if it breaks above the ascending channel pattern.

- Ether (ETH):

- Priced at $1,895.

- Broke above resistance at $1,885 and is on an upward journey toward $2,000.

- Major resistance zone between $2,000 to $2,200 that bears are expected to defend.

- A potential downside correction if it breaks below the 20-day EMA ($1,780).

- Binance Coin (BNB):

- Currently valued at $254.

- Broke and closed above resistance at $235, indicating strong demand.

- Minor resistance at $250, with a major hurdle at $265.

- First important support at $235, with a potential dip to the 20-day EMA ($227) if it breaks below.

- XRP:

- Priced at $0.71.

- Broke above resistance at $0.67, indicating bullish momentum.

- Minor resistance at $0.74, potential for a rally to $0.85 and $1.

- RSI in overbought territory suggests a possible correction or consolidation if it breaks $0.67.

- Solana (SOL):

- Currently at $40.

- Bounced off the crucial support at $38.79, but the bulls are struggling to sustain higher levels.

- Potential support at the 20-day EMA ($34.67) if it breaks below $38.79.

- Upside target is to break above $42.50 and challenge resistance at $48.

- Cardano (ADA):

- Priced at $0.370.

- Strong recovery with momentum picking up.

- RSI in overbought territory, suggesting a possible consolidation or correction.

- Key levels to watch are $0.32 and the 20-day EMA ($0.30).

- Dogecoin (DOGE):

- Currently at $0.08.

- Bounced off the strong support at the 20-day EMA ($0.07).

- Potential resistance at $0.08 and $0.10.

- Bears may attempt to pull the price below the 20-day EMA.

- Toncoin (TON):

- Trading above moving averages.

- Bulls pushed the price above $2.31 but faced selling pressure.

- Resistance at $2.59, with the potential for support at the moving averages.

- A range-bound scenario between $1.89 and $2.31 if the support at $2.31 holds.

Please note that cryptocurrency markets are highly volatile, and prices can change rapidly. Always conduct your own research and consider your risk tolerance when trading or investing in cryptocurrencies.

Is Retained Earnings an Asset?

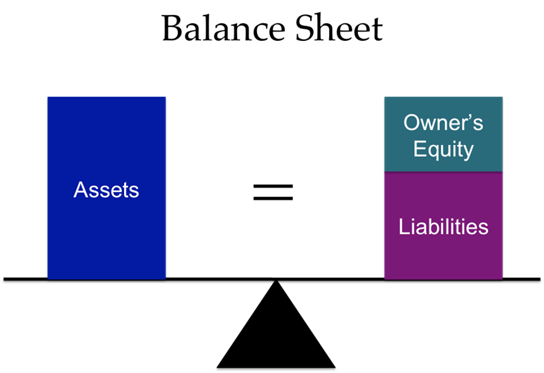

Retained earnings play a crucial role in a company's financial accounting and are an essential component of the balance sheet. Here are some key points to clarify the nature of retained earnings and their status as an asset:

- What Are Retained Earnings:

- Retained earnings represent the portion of a company's net profit that is retained and not distributed to shareholders in the form of dividends.

- On the balance sheet, retained earnings are typically included in the stockholders' equity section, reflecting the cumulative amount of earnings that have not been paid out to shareholders.

- Fluctuating Nature:

- Retained earnings are subject to change and depend on the company's financial performance.

- If a company experiences losses, retained earnings decrease.

- If the company pays dividends to shareholders, retained earnings increase.

- Management's Decision:

- Whether to retain or distribute earnings as dividends is at the discretion of the company's management.

- Companies focused on growth may choose not to pay dividends and use retained earnings for reinvestment or addressing operational needs.

- Not Classified as an Asset:

- Retained earnings are not classified as assets on the balance sheet.

- They are considered a part of stockholders' equity and represent funds set aside for shareholders.

- Listing retained earnings as assets would be misleading because they are not tangible assets but rather funds that belong to the shareholders.

- Liabilities to the Company:

- In terms of the company's financial structure, retained earnings are considered a liability because they represent obligations to shareholders.

- They are, essentially, the company's indebtedness to shareholders, as these funds belong to the stockholders.

- Calculation:

- Retained earnings can be calculated using a formula: Retained Earnings = Beginning Retained Earnings + Net Income - Dividends.

- This formula reflects the change in retained earnings over time and shows how much earnings have been accumulated since the company's inception.

- Differences from Profits:

- Retained earnings differ from profits in that they represent a portion of profits specifically set aside for future use or distribution.

- Profits refer to the overall income earned by a company from its operations, and they may include both retained earnings and dividends.

In summary, retained earnings are an important financial metric, but they are not considered assets on a balance sheet. Instead, they are a component of stockholders' equity and represent the company's obligation to shareholders. Understanding the distinction between retained earnings and profits is essential for assessing a company's financial health and its plans for utilizing earnings in the future.

Microsoft Will Bring AI Characters to Xbox

The partnership between Microsoft and Inworld AI to introduce AI characters into Xbox gaming is an exciting development that is expected to bring innovative changes to game development. Here are some key points to understand about this collaboration:

- AI-Powered Game Development: The partnership between Microsoft and Inworld AI aims to enhance game development by introducing AI characters, stories, scripts, dialogue trees, and quest lines, among other innovations. This will be made possible through the use of AI design copilots and an AI character engine.

- Empowering Game Developers: Haiyan Zhang, General Manager of Gaming AI at Xbox, emphasizes that the collaboration aims to provide game developers with better tools to create high-quality content. The goal is to deliver a versatile AI toolset that empowers creators in various aspects of game development, such as dialogue, storytelling, and quest design.

- Accessibility and Responsibility: Microsoft and Inworld AI are committed to delivering an accessible and responsibly designed multi-platform AI toolset for game developers of all sizes, worldwide. This includes a focus on ensuring accessibility and responsible use of AI technology in game development.

- Expertise and Technology: Inworld AI is expected to bring its expertise in leveraging generative AI models for character development to the partnership. Microsoft will provide its advanced cloud-based AI solutions, including Azure OpenAI Service, and technical insights from Microsoft Research to support the initiative.

- A History of Innovation: The Inworld Character Engine has been used in the gaming ecosystem before. For example, it was utilized by a modder to create an AI-powered GTA 5 story mod called "Sentient Streets." This partnership with Microsoft expands the possibilities for developers to explore new ideas and overcome limitations.

- Microsoft's Focus on AI: Microsoft has been investing heavily in the field of AI, as seen in partnerships like the one with Siemens to introduce the Siemens Industrial Copilot. Additionally, Microsoft is developing its AI chip, codenamed Athena, as part of its efforts to reduce reliance on third-party chips like NVIDIA's.

- Competition in the AI Space: Microsoft's AI endeavors are part of its long-term strategy to compete with major players in the AI field, such as OpenAI, which is also working on AI chips and exploring acquisitions in the AI chip manufacturing sector.

This collaboration between Microsoft and Inworld AI represents an exciting development in the gaming industry, as it aims to provide game developers with advanced AI tools and technologies to enhance the gaming experience for players.