Price Prediction of LUNC & DOGE. ETH Whales? And Bitcoin Innovations? [FREE PREMIUM POST]

![Price Prediction of LUNC & DOGE. ETH Whales? And Bitcoin Innovations? [FREE PREMIUM POST]](/content/images/size/w960/2024/02/cfb88477-989d-46f5-85e3-64326cc498a2.png)

Price Prediction: LUNC

- Market Structure Break: Terra Classic (LUNC) recently experienced a notable break in its bearish market structure, suggesting a potential shift in the prevailing sentiment among traders and investors. This break indicates a departure from the previous downward trend, potentially paving the way for bullish price movements.

- Short-Term Bullish Sentiment: The emergence of a bullish short-term sentiment surrounding LUNC has further bolstered expectations of price gains in the near future. This positive sentiment may be driven by various factors, including recent price movements, technical indicators, and market dynamics.

- Long-Term Outlook: Despite fluctuations in short-term sentiment, LUNC's long-term outlook appears strongly bullish. Analysis of Fibonacci retracement levels indicates that the recent rally in November and December provided a solid foundation for further price appreciation. The consolidation and subsequent breakout above key resistance levels suggest a favorable buying opportunity for traders looking to capitalize on potential future gains.

- Technical Indicators: Technical analysis of LUNC's price action reveals several bullish signals. The surge past critical resistance levels, accompanied by the Relative Strength Index (RSI) climbing above the neutral 50 level and retesting it as support, indicates robust bullish momentum. Similarly, the On-Balance Volume (OBV) trending higher suggests increasing buying pressure, reinforcing the bullish outlook for LUNC.

- Bullish Pressure: Examination of higher timeframe charts, such as weekly and 12-hour intervals, indicates a growing bullish sentiment among market participants. The rising open interest on exchanges like Binance reflects increased investor interest and confidence in LUNC's potential for future price appreciation.

- Market Cap Analysis: Evaluating LUNC's market capitalization in Bitcoin terms provides valuable insights into the cryptocurrency's relative strength and market sentiment. Analysis of market cap trends, coupled with other indicators such as trading volume and funding rates, can help traders gauge market dynamics and anticipate potential price movements.

- Disclaimer: It's essential to note that the information provided is based on analysis and opinion and should not be construed as financial or investment advice. Traders and investors should conduct thorough research and exercise caution when making trading decisions in the volatile cryptocurrency markets.

Price Prediction: DOGE

On It's Way to A Breakout?

- Dogecoin's Volatility: AMBCrypto's analysis of Dogecoin's 4-hour chart indicates extremely tight volatility, with the lower and upper layers of the Bollinger Bands converging, a situation last observed in October 2023. This tight volatility often precedes significant price movements.

- Historical Context: In the past, similar tight volatility preceded a notable price upswing for Dogecoin, suggesting a potential repeat scenario. Notably, after the last occurrence in October 2023, Dogecoin's price climbed from $0.060 to $0.075.

- Supertrend Analysis: Despite the tight volatility, the Supertrend indicator suggests caution, signaling a potential downward movement before any breakout occurs. Currently, the Supertrend for Dogecoin is indicating a sell signal, with the indicator closing above the price and showing a red color. However, this trend may change if the indicator closes below the price and turns green.

- Relative Strength Index (RSI): The RSI reading of 50.85 indicates returning buying momentum to the market. While it's not in the oversold or overbought territory, it suggests a balanced market sentiment with a potential for increased demand.

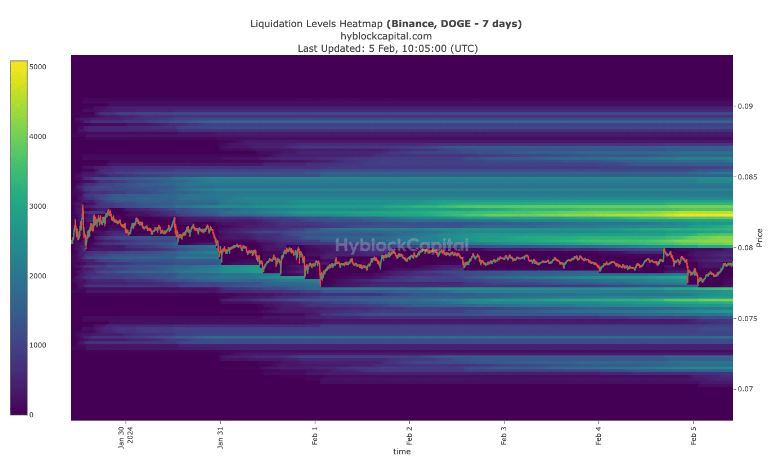

- Potential Price Targets: If demand for Dogecoin improves, there's potential for a 12% increase, pushing its price to $0.090. However, the $0.080 region is crucial, as it acts as a resistance level that Dogecoin needs to break for further upside potential.

- Liquidation Heatmap: Large liquidations might occur around $0.083, posing risks for long positions with high leverage. Traders should be cautious around this price level to manage their risk effectively.

- Open Interest (OI): OI stands at $422.09 million, suggesting a slight increase from the previous 24 hours. This indicates growing interest and participation in Dogecoin trading, potentially leading to increased market volatility.

- Market Cap Analysis: Considering Dogecoin's price action alongside OI, an impulsive movement is anticipated. A breakout above the $0.080 resistance level could trigger further upside, with potential price targets at $0.095 and even $0.01 in a highly bullish scenario. Traders should closely monitor these levels for potential trading opportunities.

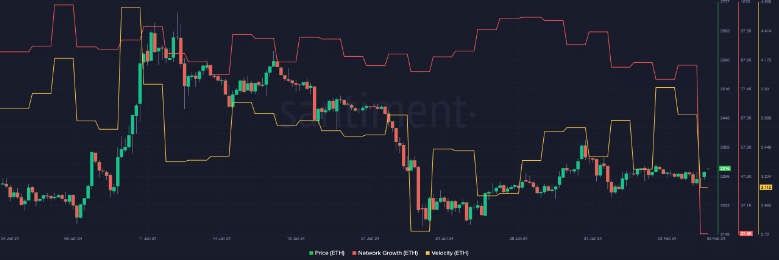

ETH Whales Start to Show Interest

- Market Sentiment: Despite the recent whale activity and modest price increase, market sentiment remains cautious due to lingering concerns about Ethereum's scalability issues, high gas fees, and the potential impact of upcoming upgrades like Ethereum 2.0.

- Investor Outlook: Long-term investors are closely monitoring developments such as Ethereum's transition to a proof-of-stake consensus mechanism, which promises improved scalability and reduced environmental impact. These developments could significantly impact Ethereum's price trajectory in the coming months and years.

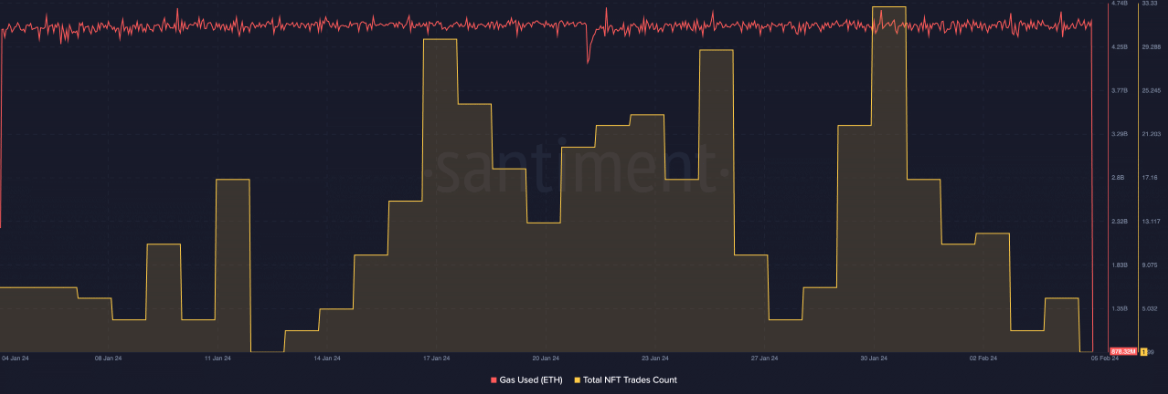

- Regulatory Environment: Regulatory uncertainty surrounding cryptocurrencies, including Ethereum, adds another layer of complexity to market dynamics. Changes in regulatory policies, especially regarding decentralized finance (DeFi) and non-fungible tokens (NFTs), could influence investor sentiment and market activity.

- Technological Advancements: Continued innovation in the Ethereum ecosystem, such as the proliferation of layer 2 scaling solutions and the development of interoperability protocols, could bolster Ethereum's long-term viability and address some of its current limitations.

- Overall Market Trends: Ethereum's performance is also influenced by broader market trends in the cryptocurrency space, including the movements of major assets like Bitcoin and the emergence of new trends such as decentralized autonomous organizations (DAOs) and metaverse projects.

'Miracle year' for 'Godzilla' Bitcoin With Coming Innovations

In a recent podcast, Edan Yago, CEO of Epiphyte, emphasized Bitcoin's role as the bedrock of a decentralized financial system, citing its security and longevity. Key points include:

- Bitcoin's Growth: Technological advancements and regulatory milestones, like spot BTC ETFs and the upcoming halving, are expected to drive institutional adoption and tighten supply, potentially leading to price surges.

- Enhancements: Innovations like roll-ups and technologies such as Ordinals and BRC-20 tokens are enhancing Bitcoin's functionality without altering its core code, enabling scalability and support for complex smart contracts.

- Altcoins Outlook: Yago predicts a diversification of the blockchain landscape, with Bitcoin maintaining dominance while other networks find their niche. Ethereum's dominance may gradually decline over the next five to ten years.

- Mainstream Adoption: Bitcoin's appeal is reinforced by increasing digital adoption and institutional skepticism, accelerated by the COVID-19 pandemic. Its simplicity and security contrast with traditional global transaction methods, fostering mainstream acceptance.

In summary, Bitcoin's evolution as the cornerstone of decentralized finance, coupled with its resilience and growing institutional acceptance, positions it for long-term viability and mainstream adoption.