Bitcoin Might Be Up for a 2-Year Bull Run

Yield Curve Analysis and Bitcoin Price Movement

The research paper discusses the potential for a bull market for Bitcoin (BTC) in the next one to two years. The analysis by Michaël Van de Poppe, Founder of MN Trading, focuses on signals from the bond market and their implications for Bitcoin's price movement. Van de Poppe highlights a bearish divergence on the 2-year and 10-year T-bill yields, indicating market pessimism based on economic numbers and the response to the Federal Open Market Committee's (FOMC) monetary policy decisions.

Technology Stocks and Bitcoin

The paper also discusses the correlation between inflation, technology stocks, and Bitcoin's price movement. It notes that lower borrowing costs resulting from Federal Reserve rate reductions are generally positive for technology stocks, which could also benefit Bitcoin. Additionally, the paper refers to historical trends where a bull market followed a similar yield curve trend in 2018, mirroring the current market trajectory.

Halving Event and ETF Approval

Furthermore, the paper mentions the upcoming Bitcoin halving event and the potential approval of the first Bitcoin spot exchange-traded fund (ETF) as factors influencing Bitcoin's price movement. It notes historical post-halving gains and the anticipation of an influx of retail money if the ETF is approved.

Promising Bitcoin Outlook

Overall, the paper presents a promising outlook for Bitcoin's price movement in the next year or so, considering various macroeconomic and regulatory factors. The analysis suggests that Bitcoin might be up for a bull market based on the observed yield curve trends, historical post-halving gains, and the potential ETF approval.

Crypto Products of The Year 2023:

Solana Saga Smartphone:

- Designed for the Solana ecosystem, the Saga smartphone features a built-in hardware wallet and a native store for decentralized applications (dapps).

- Priced at $1,000, it offers Web3 integration but may face competition from top-end smartphones like those from Apple and Samsung.

Trezor Safe 3:

- Trezor Safe 3 is a hardware wallet targeting newcomers to the crypto space.

- It provides a sleek design and user-friendly interface, emphasizing security for crypto assets.

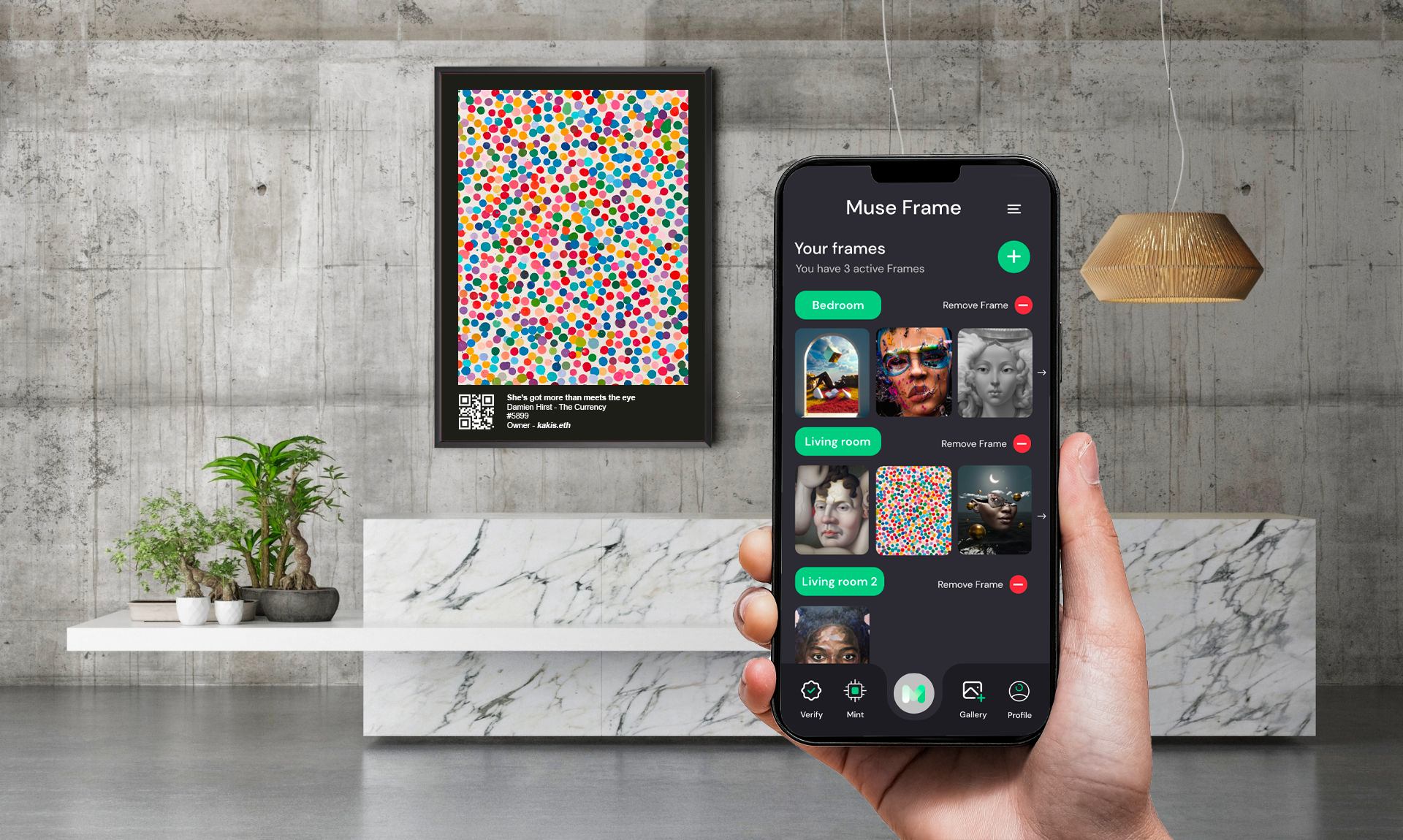

Muse Frame:

- Muse Frame offers digital art frames catering to NFT enthusiasts, allowing them to showcase their digital artwork on walls.

- Available in various sizes with features like rotatable mounts, 4K displays, HD speakers, and an anti-glare screen.

Trezor Keep Metal:

- Trezor Keep Metal is a metal wallet designed to securely store mnemonic recovery seeds.

- Made from aerospace-grade stainless steel, it provides durability and protection against external factors.

Nike x RTFKT Dunk Ghost Edition and Dunk VOID Edition:

- Nike and crypto subsidiary RTFKT collaborated on sneaker drops, featuring NFTs with embedded NFC chips.

- Users can obtain digital collectibles and link them with physical sneakers.

Vertu Metavertu II:

- The Metavertu II is a luxury Web3 smartphone targeting the crypto-rich, priced up to $9,300 and featuring alligator skin.

- Offers Web3-friendly features, including a built-in crypto wallet and a dedicated decentralized operating system.

Meta Quest 3:

- The Meta Quest 3 is a product from Meta, formerly Facebook, providing a consumer-friendly entry into the metaverse.

- Meta's virtual land grab and the concept of the "open metaverse" are highlighted, contrasting with a potential walled garden approach.

- These products represent a trend toward making crypto more accessible and integrated into everyday life, with an emphasis on design, functionality, and security. The developments in 2023 reflect the industry's efforts to appeal to a broader audience of mainstream consumers.

XRP Rich List 2023: Who Are The Top 10 Largest XRP Holders?

As of December 25, 2023, XRP is experiencing strong demand among investors, evident in the following on-chain data:

- Addresses in the Top 0.01%:

- Wallets holding at least 5.75 million XRP, representing the top 0.01%, have increased to 486.

- This indicates robust demand and interest in XRP among larger investors.

- Millionaire Addresses:

- Millionaire addresses, which typically hold at least 1 million XRP, have declined to 1,970.

- The decrease in millionaire addresses may suggest a concentration of XRP holdings in larger wallets.

- XRP in Circulation:

- As of December 25, more than 59 billion XRP coins are in circulation.

- The total market capitalization of XRP stands at approximately $34.44 billion.

- Top 10 Addresses and Distribution:

- The top 10 largest addresses on the XRP rich list control about 11% of all XRP coins in circulation.

- This amounts to over $4 billion at current market prices.

- Top 50 Holders:

- The top 50 largest XRP holders collectively control more than 26.24% of XRP's total circulation.

- This represents a significant portion of the overall XRP supply, totaling over $10 billion.

- Largest XRP Holders:

- The largest XRP holder is associated with Ripple and holds about 1.96 billion XRP coins in a single wallet.

- The second-largest address is also linked to Ripple.

- Ripple and Co-founders:

- Ripple, Executive Chairman Chris Larsen, and CEO Brad Garlinghouse are significant holders of XRP.

- Larsen is reportedly one of the largest holders with over 5 billion XRP, distributed across multiple addresses.

- XRP Supply Distribution:

- The XRP supply is limited to 100 billion, and unlike most cryptocurrencies, XRP is pre-mined.

- Initial distributions included 20 billion XRP for Ripple co-founders.

- Jed McCaleb:

- Jed McCaleb, a co-founder who left Ripple in 2014, has offloaded his entire XRP holdings since then.

- Centralized Exchanges:

- Crypto exchanges like Binance, Kraken, Uphold, and Bitbank also hold significant amounts of XRP.

- These holdings are typically customer deposits kept in reserves.

The data indicates a concentration of XRP holdings among a relatively small number of large addresses, including those associated with Ripple and key figures in its leadership. This concentration can impact the market dynamics and influence the overall supply and demand for XRP.