[BONUS + FREE PREMIUM CONTENT] Top 10 Bot Trading Strategies to Automate Your Trading

![[BONUS + FREE PREMIUM CONTENT] Top 10 Bot Trading Strategies to Automate Your Trading](/content/images/size/w960/2024/02/ai-crypto-bots.webp)

HERE IS A FREE PREMIUM BONUS POST,

SINCE THERE WERE NO STANDARD FREE POST LAST WEEK

Top 10 Bot Trading Strategies to Automate Your Trading:

- Moving Average Trading (SMA, EMA):

- Simple Moving Average (SMA): Calculates the average price over a specified period, smoothing out price fluctuations to identify trends more clearly. It's effective for capturing long-term trends and is relatively easy to understand and implement.

- Exponential Moving Average (EMA): Similar to SMA but gives more weight to recent prices, making it more responsive to short-term price movements. This makes EMA suitable for capturing rapid market changes and adjusting trading strategies accordingly.

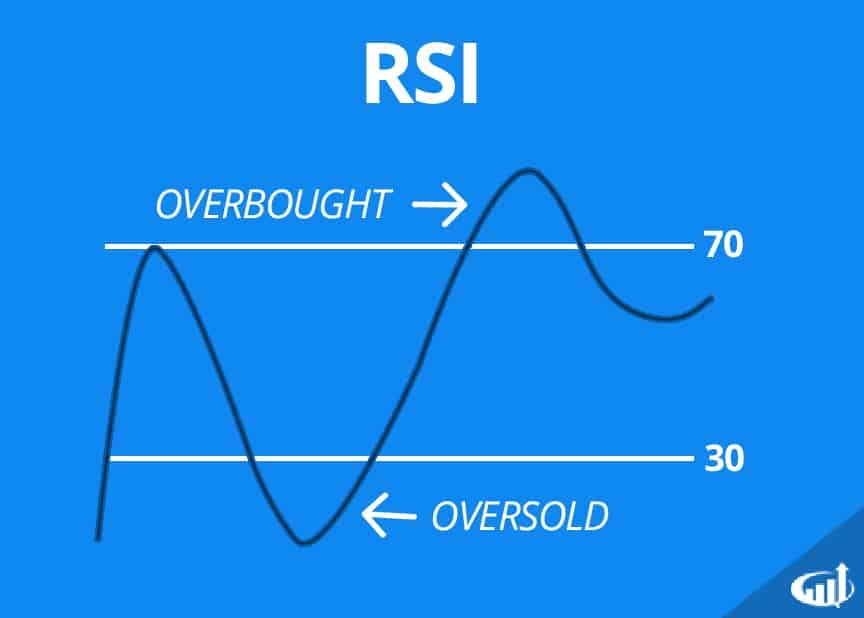

- RSI (Relative Strength Index):

- RSI measures the magnitude and velocity of price movements to determine overbought or oversold conditions. It's a valuable tool for assessing market sentiment and identifying potential trend reversals. Integrating RSI criteria into trading bots automates trade decisions based on predefined thresholds, enhancing efficiency in execution.

- MACD (Moving Average Convergence Divergence):

- MACD provides insights into the relationship between two moving averages, indicating changes in momentum and potential trend reversals. By analyzing signal line crossings and divergences between MACD and price movements, trading bots can identify optimal entry and exit points, improving trade accuracy and profitability.

- Bollinger Band:

- Bollinger Bands consist of three lines: a middle line representing the moving average and upper and lower bands denoting standard deviations from the average. These bands dynamically adjust to market volatility, expanding during periods of high volatility and contracting during low volatility. Trading bots use Bollinger Bands to identify price extremes, potential trend reversals, and volatility expansions, optimizing trade entries and exits.

- Fibonacci Retracement:

:max_bytes(150000):strip_icc()/dotdash_INV-Fibonacci-Retracement-Levels-June-2021-01-a036f12c487e47e08e14ab42e1f1823b.jpg)

- Fibonacci Retracement levels, derived from the Fibonacci sequence, help identify potential support and resistance levels based on historical price movements. Trading bots leverage these levels to anticipate price reversals or continuations, enhancing trade timing and precision. By incorporating Fibonacci retracement into their strategies, bots capitalize on market patterns and enhance overall profitability.

- Pivot Reversal:

- Pivot points, calculated from previous high, low, and closing prices, serve as key indicators of potential trend reversals and overall market sentiment. Trading bots utilize pivot points to identify strategic entry and exit points, aligning trades with prevailing market conditions. By interpreting pivot levels, bots optimize trade placement and maximize profit potential.

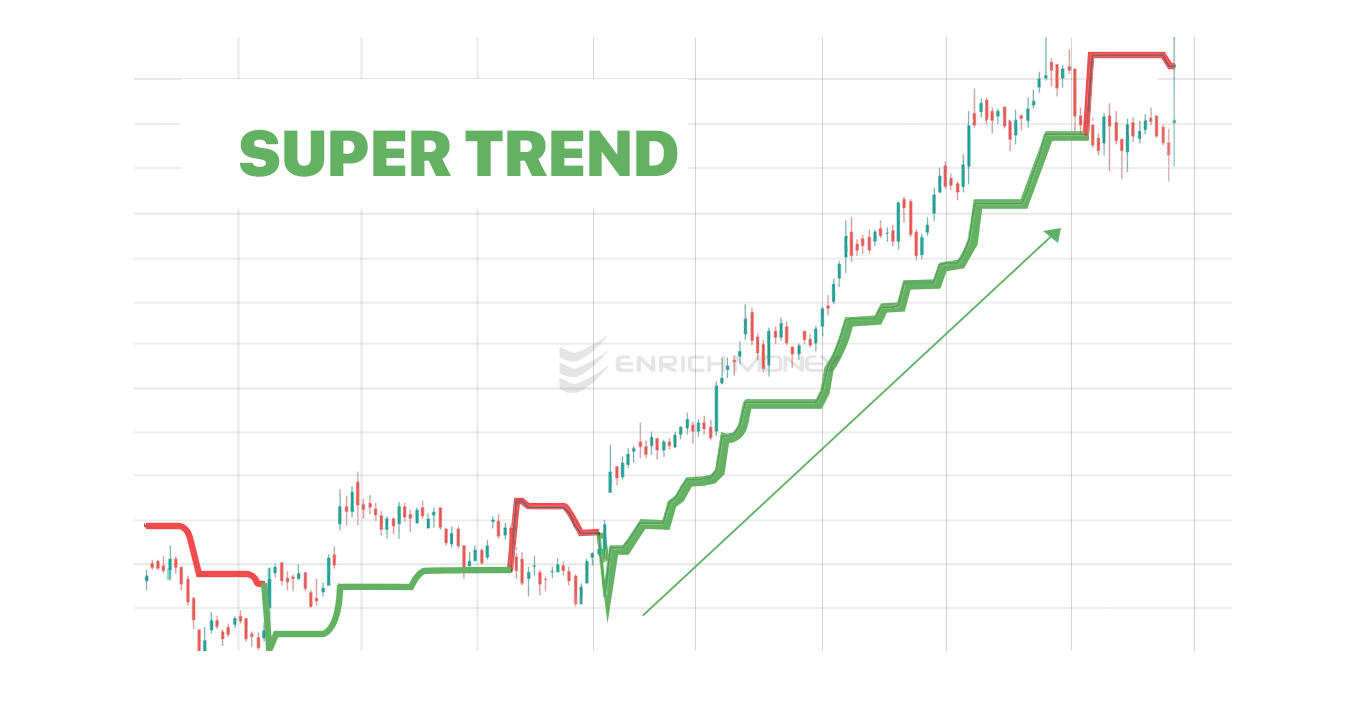

- Supertrend:

- Supertrend, based on the Average True Range (ATR), helps identify trends and potential trend reversals. Positioned above or below price charts, Supertrend lines provide clear signals of bullish or bearish market sentiment. Trading bots use Supertrend indicators to automate trade execution, ensuring timely entries and exits based on prevailing market trends.

- Parabolic SAR (Stop and Reverse):

- Parabolic SAR detects potential changes in market momentum, indicating optimal entry and exit points. By tracking SAR dots' positions relative to price charts, trading bots identify trend directions and adjust trading strategies accordingly. Integrating Parabolic SAR into bot strategies enhances trade accuracy and profitability, particularly in trending markets.

- Mean Reversion:

- Mean Reversion strategies capitalize on price deviations from the mean, exploiting market inefficiencies for profit. Trading bots monitor price movements relative to historical averages, identifying opportunities to buy low and sell high. By executing trades based on mean reversion principles, bots optimize profit potential and mitigate risk in fluctuating market conditions.

- Arbitrage:

:max_bytes(150000):strip_icc()/arbitrage-4201467-1-705aa79c9d6f4128b8eb7b9588403849.jpg)

- Arbitrage strategies exploit price differentials between markets or trading pairs, generating profit from market inefficiencies. Automated bots scan multiple exchanges for price disparities, executing trades to capitalize on arbitrage opportunities swiftly. By leveraging arbitrage strategies, bots enhance profit potential and liquidity management, maximizing returns in dynamic market environments.

Make $500 A Day From Home With Free Cloud Mining

Make $500 a Day from Home with Free Cloud Mining:

1. What is Cloud Mining?

- Cloud mining is the process of cryptocurrency mining using remote data processing centers, allowing users to mine cryptocurrency without investing in expensive equipment.

2. Introduction to Inccrypto:

- Inccrypto is a leading cloud mining platform operating five mining farms globally, with over 320,000 users in 150+ countries.

- Users can participate in free cloud mining and utilize new energy sources for mining, reducing costs and increasing income.

3. Advantages of Inccrypto:

- Free mining contracts available for all users.

- User-friendly interface suitable for beginners.

- Wide variety of contracts to meet different needs.

- High-performance equipment and global data processing centers.

- Cost-effective with no expenses for equipment and maintenance.

- Ability to earn passive income automatically after purchasing a contract.

4. Contracts Offered by Inccrypto:

- Contract durations range from 1 to 7 days, with corresponding daily payouts and total income.

- Contracts include free options and paid options with varying prices and earnings potential.

5. Conclusion:

- Cloud mining with Inccrypto offers a lucrative opportunity for earning passive income online in 2024.

- With its simple interface, diverse contract options, advanced infrastructure, and cost-effectiveness, Inccrypto stands out as an attractive choice for cryptocurrency enthusiasts.

- By utilizing Inccrypto for cloud mining, users can tap into potential income streams and participate in the evolving landscape of digital currencies.

Disclaimer: This is NOT SPONSORED, but also NOT INVESTMENT NOR FINANCIAL ADVICE

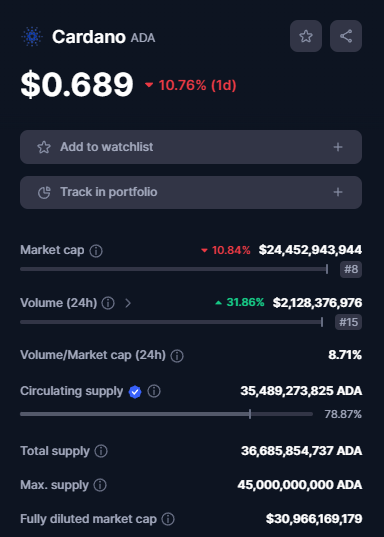

CARDANO Price Prediction:

Cardano Price Predictions 2024-2033:

1. Introduction:

- Cardano (ADA) is a project with significant potential beyond its role as a tradable asset, rooted in scholarly peer-reviewed research and boasting a robust community.

- ADA's current price is:

2. Price Predictions:

- 2024: ADA is forecasted to reach a minimum price of $0.9678, an average price of $1.00, and a maximum price of $1.14.

- 2027: Price predictions suggest ADA could reach a minimum of $3.00, an average of $3.11, and a maximum of $3.58.

- 2030: ADA's price is projected to potentially rise to $11.39 by 2030 and $31.16 by 2033.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2024 | $0.9678 | $1.00 | $1.14 |

| 2025 | $1.42 | $1.46 | $1.70 |

| 2026 | $2.10 | $2.16 | $2.53 |

| 2027 | $3.00 | $3.11 | $3.58 |

| 2028 | $4.57 | $4.70 | $5.27 |

| 2029 | $6.57 | $6.76 | $7.91 |

| 2030 | $9.09 | $9.36 | $11.39 |

| 2031 | $13.09 | $13.46 | $15.74 |

| 2032 | $18.14 | $18.81 | $22.42 |

| 2033 | $26.85 | $27.60 | $31.16 |

3. Price Analysis:

- ADA's price analysis indicates a bullish trend, with strong buying pressure and potential resistance at $0.7966.

- The 1-day and 4-hour price charts show bullish patterns, with the price steadily rising and potential for further gains.

- Technical indicators such as the Bollinger bands and Relative Strength Index (RSI) suggest positive momentum and potential for upward movement.

4. Recent News and Opinions:

- Cardano secures its position as the second-leading decentralized cryptocurrency asset, reflecting its commitment to decentralization.

- Analysts project significant growth for ADA in 2024, with predictions ranging from $10 to $30, driven by factors such as institutional interest and technological advancements.

- Cardano's ecosystem continues to expand, with developments such as the launch of Alonzo Testnet and partnerships with NFT artists.

5. Cardano's History and Projects:

- ADA has experienced significant price fluctuations since its launch in 2017, with recent highs in 2021.

- Cardano has been involved in various projects, including enterprise blockchain frameworks, partnerships with companies like New Balance, and initiatives like Project Atlas and Project Catalyst.

- The Cardano ecosystem is accelerating in the NFT space, with partnerships with artists and the launch of projects like Starship Universe.

6. Conclusion:

- Cardano's price predictions for 2024-2033 are optimistic, driven by factors such as technological advancements, institutional interest, and market trends.

- Investors should conduct thorough research and consider market dynamics before making investment decisions in ADA or any cryptocurrency.

Kucoin Crypto Earn & Trading Bot

- KuCoin Introduction: KuCoin, founded by Michael Gan and Eric Don, is a user-friendly cryptocurrency exchange aimed at making crypto trading accessible to beginners.

- Product Offerings:

- KuCoin Leveraged Token: A derivative tradable on KuCoin, providing leveraged profits without expiration dates or negative values, managed by fund managers.

- KuCoin Earn: A platform offering various profit-yielding products and services, allowing users to earn income in cryptocurrencies with flexibility.

- KuCoin Trading Bot: An automated trading tool for over 250 digital assets, operating 24/7 to track market volatility and arbitrage opportunities, enabling users to earn passive income even during volatile market conditions.

- Advantages of Trading Bots: Trading bots reduce repetitive work, seize trading opportunities, and help users earn passive income, although users must be aware of potential risks and the need for constant adjustments.

- Varieties of Trading Bots: KuCoin offers five trading bots designed for different strategies and trading patterns, catering to various investor preferences and objectives.

- The Downside of Trading Bots: While trading bots offer advantages, users should be cautious as many online bots are overpriced and may not perform well. Institutional investors commonly use trading bots, which require constant adjustment to reflect changing market conditions. Some trading bots are controlled by someone, with that being said, trading bots usually work as good as the person directing them.

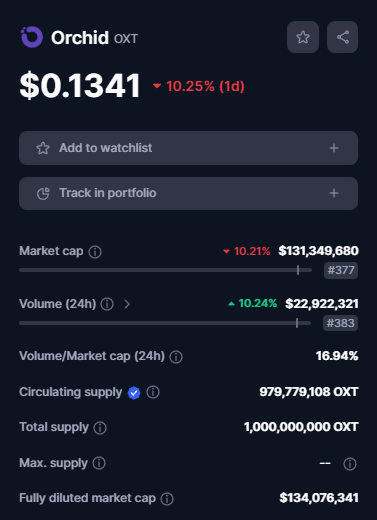

ORCHID (OXT) Price Prediction:

Introduction to Orchid (OXT)

Orchid is a decentralized technology for anonymous web browsing, utilizing its native token, OXT, within its network for bandwidth sharing and staking by providers.

Orchid (OXT) Long-Term Price Prediction

| Year | Lowest Price ($) | Average Price ($) | Highest Price ($) |

|---|---|---|---|

| 2025 | $2.78 | $4.90 | $7.32 |

| 2026 | $6.44 | $8.91 | $11.97 |

| 2027 | $5.10 | $7.51 | $9.64 |

| 2028 | $4.87 | $7.21 | $8.92 |

| 2029 | $8.03 | $11.21 | $14.70 |

| 2030 | $11.99 | $16.71 | $22.89 |

Orchid (OXT) Technical Analysis

Technical analysis tools such as moving averages, relative strength index (RSI), and volume-weighted average price (VWAP) are utilized for predicting Orchid's future price movements.

Orchid Price Predictions FAQs

- What is Orchid?: Orchid is a decentralized technology for anonymous web browsing, utilizing its native token, OXT, within its network for bandwidth sharing and staking by providers.

- What factors can influence Orchid(OXT) price predictions?: Factors influencing Orchid price predictions include market trends, investor sentiment, technological advancements, regulatory changes, and competition.

- Is Orchid a good investment?: Orchid's suitability as an investment depends on individual risk tolerance and investment goals. It is advised to conduct thorough research before investing.

- What is the highest price ever reached by Orchid?: Orchid reached its highest price of around $1.03 in April 2021.

Disclaimer: Orchid price predictions are speculative and for informational purposes only. Cryptocurrency markets are volatile, and investors should conduct their own research and seek financial advice before making investment decisions.