Top 10 Cryptos to STAKE for Passive Income [FREE POST]

![Top 10 Cryptos to STAKE for Passive Income [FREE POST]](/content/images/size/w960/2023/10/Old-Blog-35.png)

Staking has become a popular way for crypto enthusiasts to earn passive income while supporting blockchain networks. Here's a breakdown of the content you've shared:

1. What is Staking?

- Staking involves holding and locking a specific amount of cryptocurrency in a wallet to support the operations of a blockchain network.

- Participants usually receive staking rewards, typically in the form of additional coins.

2. How to Stake Cryptos

- Acquire Coins: Purchase the cryptocurrency you intend to stake.

- Choose a Wallet: Store your cryptocurrency in a secure and staking-enabled wallet. Some projects have official wallets, while others might be supported by multi-coin wallets.

- Lock Up Funds: Staking might require you to lock up your funds for a set period. Ensure you’re comfortable with the terms.

- Delegate or Run a Node: Depending on the cryptocurrency, you can either delegate your coins to a staking pool or run your own staking node.

- Earn Rewards: Once you’ve started staking, rewards typically get distributed periodically into your staking wallet.

3. Top 10 Cryptos to Stake in 2023

- Ethereum (ETH)

- Cardano (ADA)

- Polkadot (DOT)

- Tezos (XTZ)

- Cosmos (ATOM)

- Algorand (ALGO)

- Solana (SOL)

- Binance Coin (BNB)

- Avalanche (AVAX)

- Tron (TRX)

4. Where to Stake Cryptos

- Many exchanges offer simplified staking services, allowing users to earn rewards without setting up their own nodes.

- Some popular exchanges for staking include Binance, Kraken, Coinbase, KuCoin, and Bitfinex.

This information provides a comprehensive overview of staking in the cryptocurrency space, the top coins to consider staking in 2023, and where you can conveniently stake your cryptocurrencies.

UK’s FCA Adds 143 Crypto Entities In Its Warning List Of Unregistered Firms

The UK's Financial Conduct Authority (FCA) has taken regulatory actions against non-authorized operators in the country's crypto sector. Here's a summary of the key points from the provided information:

- Updated Warning List: On Sunday, October 8, the FCA released an updated warning list of firms that are not authorized to operate in the UK's financial sector. This is part of the UK's efforts to regulate and control unregulated activities in the crypto sector.

- Strict Financial Rules: The FCA has become more stringent in enforcing financial rules and regulations in the country, particularly within the crypto industry.

- Entities Added to Warning List: The FCA added about 143 new entities to the warning list, including well-known cryptocurrency exchanges such as KuCoin and Huobi-owned HTX. The FCA advised people to avoid dealing with these firms.

- Huobi and KuCoin Responses: Huobi and KuCoin responded by stating that they do not operate in the United Kingdom. They also expressed their willingness to adjust their operations to ensure compliance with relevant laws and regulations in each country.

- Mandate for Registration: The FCA now mandates all financial entities operating in the UK to register with the regulator or obtain a temporary grant to operate.

- Clear Risk Warnings: Crypto firms operating in the UK are required to display clear risk warnings to their customers. They must also adhere to higher technical standards set by the regulatory rules.

- Limited Number of Registered Firms: Only 42 crypto asset providers are fully registered with the FCA, including firms like Gemini and Bitstamp Revolt, out of 291 applications received since 2020.

- Penalties for Non-Compliance: The FCA's head of crypto financial promotions, Jayson Probin, mentioned that non-compliant firms could face criminal charges. The regulator is taking a robust stance against illegal promotion to UK consumers.

These regulatory actions reflect the UK's efforts to enhance oversight and compliance within the cryptocurrency industry and protect consumers from unscrupulous operators.

Will The Fed Cut Interest Rates?

Billionaire venture capitalist Chamath Palihapitiya has his perspective regarding inflation, the oil market, and its potential impact on cryptocurrencies. Here's a summary of the key points:

- Inflation Outlook: In the middle of 2021, the Federal Reserve (Fed) suggested that inflation was temporary, but some investors were skeptical. Palihapitiya believes that excessive optimism about the Fed's stance on inflation may lead to disappointment.

- Fed's Path: Palihapitiya believes that the Fed will not deviate from its current path and is unlikely to cut interest rates in response to rising inflation.

- Oil Prices: The escalating conflict between Israel and Hamas is expected to contribute to rising oil prices. Janet Yellen, the U.S. Treasury Secretary, expressed a desire to lower oil prices to $60.

- Low Oil Reserves: According to data from The Kobeissi Letter, the U.S. strategic oil reserve is at an extremely low level, equivalent to a 17-day supply. This limits the U.S. government's ability to increase supply to stabilize prices.

- Impact on Cryptocurrencies: Rising oil prices are linked to inflation, which, in turn, affects Federal Reserve policy. Palihapitiya suggests that if oil prices rise, it could have a negative impact on cryptocurrencies.

- Fed's Response: Palihapitiya questions what the Fed will do if inflation increases. He believes that the Fed is under pressure to avoid causing damage to the bond market and to start a rate-cut cycle. However, the situation in the oil market may make this path less likely.

- Interconnected Factors: Palihapitiya highlights the interconnectedness of various factors, such as inflation, oil prices, Federal Reserve policy, and cryptocurrencies, and how changes in one can affect the others.

It's important to note that financial markets are complex, and the relationships between different asset classes and economic indicators can be multifaceted. The views expressed by Chamath Palihapitiya represent his perspective on the potential impact of rising oil prices on cryptocurrencies and should not be considered as financial advice. Investors should conduct their research and consider various factors when making investment decisions, especially in the highly volatile cryptocurrency market.

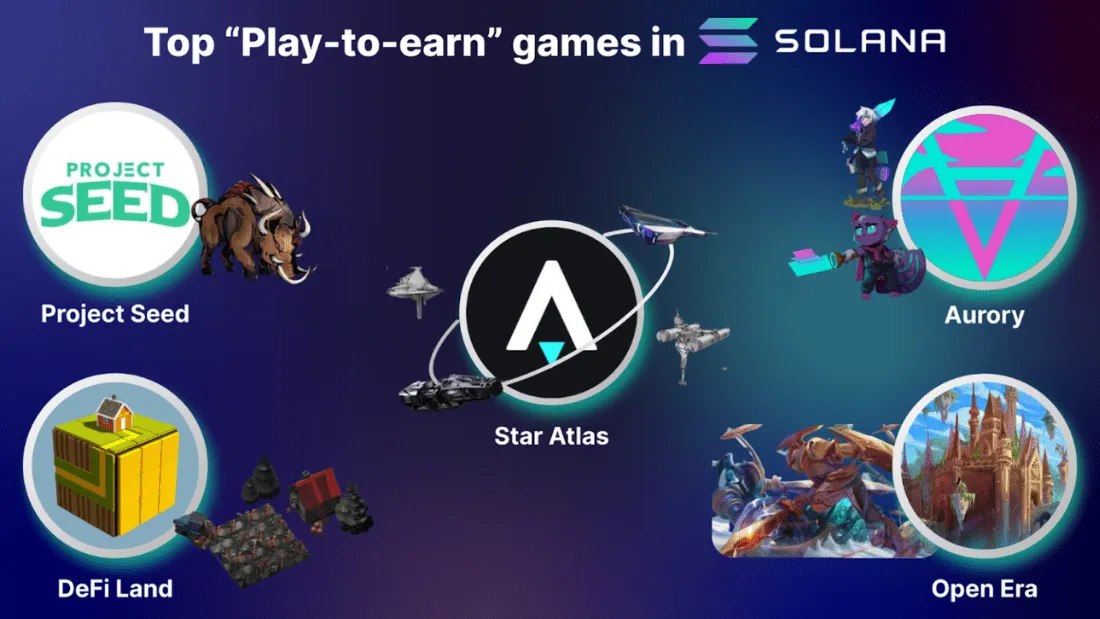

Just One Game on Solana Is Doing More Daily Transactions Than All of Polygon

SAGE Labs, a browser-based sci-fi game experience on the Solana blockchain created by the Star Atlas team, has generated significant transaction activity, surpassing Polygon's total network transactions on a single day.

- Transaction Volume: SAGE Labs recorded over 2.29 million transactions on a single Sunday, surpassing the total number of transactions on the Polygon network by about 256,000 transactions.

- Total Transactions: Since its launch last month, SAGE Labs has accumulated over 16 million transactions. The game operates on the Solana blockchain, and nearly every interaction requires users to sign transactions with their wallets, incurring small gas fees for verification.

- Game Description: SAGE Labs is described as a 2D space management simulation experience that emphasizes menus, simulated resource management tasks, and data, rather than being a 3D immersive gaming experience like the core Star Atlas MMORPG in development.

- Comparison with Polygon: The transaction volume on SAGE Labs alone accounted for about 15% of all activity on the Solana network on a specific day. However, the high number of transactions per player suggests a unique design in the game.

- Bot Activity: There is speculation about whether some of the transactions on SAGE Labs might be from bots or automated accounts. The developer, ATMTA, has not commented on this matter.

- Web3 Gaming Model: Unlike many other blockchain games that offer optional crypto experiences, SAGE Labs requires players to have a Solana-compatible wallet and hold SOL or ATLAS tokens in their wallet to create characters and progress in the game. It offers a fully on-chain gaming experience.

- Challenges for Star Atlas: While SAGE Labs has seen substantial traffic, Star Atlas, the parent project, faced economic challenges earlier in the year, including laying off a significant portion of its staff. The layoffs were made to adapt to market conditions and ensure the project's continued development.

The significant transaction activity on SAGE Labs reflects the growing interest in blockchain-based gaming experiences and the Solana blockchain's capacity to handle high transaction volumes. However, questions remain about the nature of some of these transactions and the potential presence of automated accounts.