Tradecurve surge? Huobi Token and Binance (BNB) Face New Rival

Tradecurve is a hybrid trading exchange that combines the best elements of centralized and decentralized exchanges. Tradecurve enables users to effortlessly trade forex, stocks, commodities and crypto all from one account without the need to fulfil strenuous KYC requirements. We believe that trading should be borderless and everyone should have the opportunity to control their financial futures, welcome to the future of online trading.

Tradecurve (TCRV) is emerging as a potential disruptor in the crypto landscape and is predicted to be a strong rival to established players like Huobi Token (HT) and Binance (BNB). Tradecurve offers an all-in-one trading platform with features like copy trading, AI-assisted automated trading, staking, and substantial leverage. Market sentiment towards Tradecurve is positive, and analysts predict its price could surge to over $1.00 in the next year.

Huobi Token (HT) is facing regulatory pressure and a steep decline in price, leading to challenges in the market. Tradecurve's debut is seen as a potential threat to take away market share and further depress HT's token price.

Binance (BNB) is also dealing with regulatory scrutiny and a decline in its token price. The future of Binance depends on navigating regulatory challenges and regaining user trust. With the arrival of Tradecurve, Binance faces a new rival that could siphon off its market share, and some Binance holders are selling their tokens to participate in the Tradecurve presale.

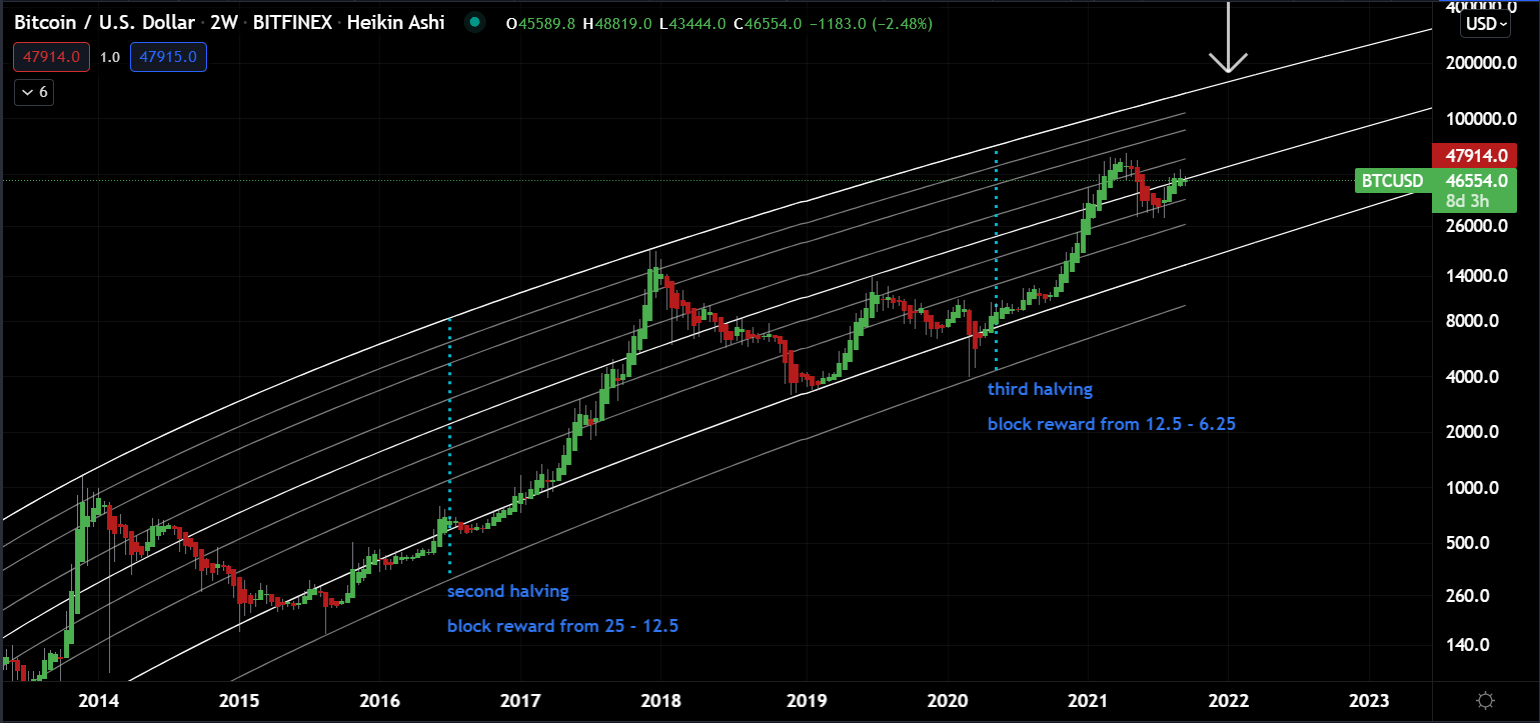

Bitcoin’s Recent Drop Did Not Affect the Long-Term Positive Outlook

Crypto analyst Credible Crypto predicts that Bitcoin could see significant monthly gains surpassing $10,000. However,

the recent drop in Bitcoin's price to around $29,100 might delay the expected rise. The analyst advises investors to be patient and not be discouraged by short-term fluctuations.

Additionally, Credible Crypto expresses bullish expectations for Curve Finance (CRV), a decentralized finance (DeFi) altcoin. The analyst believes that there is a high probability of the CRV price hitting rock bottom and then potentially pulling back towards the mid-$0.50 range after an upward movement.

As of now, CRV is trading at $0.5894 with a 4.52% increase in the past 24 hours, despite experiencing a 20% loss in the last 7 days.

How an Ex-Goldman Banker Fought US Sanctions Over Russia — and Won

The increased use of sanctions by the US and its allies in response to Russia's invasion of Ukraine has led to collateral damage for some individuals. Elena Titova, a former investment banker with ties to Russian state-run lender Bank Otkritie, found herself on the US list of "Specially Designated Nationals," which severely restricts access to the American-dominated financial system. Despite resigning from the bank, she faced difficulties with foreign banks cutting off access to her accounts and had trouble paying living expenses.

Titova's experience highlights the challenges faced by individuals caught up in the sanctions regime. Many wealthy and powerful Russians have been sanctioned since the invasion, with their assets frozen. Some have successfully challenged the sanctions, but the process can be lengthy and opaque.

Titova, along with other former Otkritie directors who were also sanctioned, filed a petition to be removed from the list. After months of back-and-forth with the State Department, she was eventually removed from the list. However, the damage to her reputation and financial standing may take a long time to repair.

The use of sanctions has become a key tool in the geopolitical landscape, but it also raises questions about due process and the impact on individuals who may not be directly involved in the actions that led to the sanctions.