[EXTRA NEWS] Will You Still Trust DOGE After Reading This?

![[EXTRA NEWS] Will You Still Trust DOGE After Reading This?](/content/images/size/w960/2024/02/What-is-dogecoin.webp)

Dogecoin Faces Volatility Amidst Correction

Dogecoin (DOGE), the iconic memecoin, experienced a sharp correction in the last 24 hours of trading, highlighting the inherent risks associated with meme-inspired cryptocurrencies.

Despite the recent rally, memecoins like Dogecoin remain a precarious investment choice within the crypto market, as their value can be highly volatile and subject to rapid fluctuations. This volatility has been a topic of concern among various circles, including casual investors and industry experts.

Recent Performance and Market Sentiment:

- Dogecoin witnessed a surge starting from February 17th, reaching a peak of $0.090 on February 20th at 12:45 am UTC, as reported by CoinMarketCap.

- However, profit-taking activities by investors led to a subsequent decline, with DOGE trading at $0.086 at the time of writing, partially retracting the gains made during the uptrend.

Network Strength and Activity:

- Despite the recent correction, Dogecoin has shown positive performance since the beginning of February, accumulating gains of 8% month-to-date (MTD).

- On-chain activity has also witnessed improvement, with Dogecoin processing over a million transactions daily over the past three weeks, according to analytics firm IntoTheBlock.

Whale Activity and Market Sentiment:

- The rally attracted increased interest from whale investors, as transactions worth over $100K spiked to a two-month high before the price downturn prompted a reversal.

- However, Dogecoin's over-reliance on notable figures like Elon Musk for price movements remains a concern, as developments related to Musk-owned companies often influence DOGE's value.

Long-Term Prospects and Challenges:

- Despite its popularity and community support, Dogecoin's lack of significant real-world utility poses challenges for sustained growth.

- Addressing this issue and diversifying its use cases beyond meme appeal will be crucial for Dogecoin's viability and long-term success in the cryptocurrency market.

Conclusion:

- Dogecoin's recent correction underscores the inherent volatility and speculative nature of memecoins within the crypto market.

- While the coin continues to attract attention and maintain a dedicated community, addressing fundamental challenges and broadening its utility will be essential for Dogecoin's resilience and sustainability in the long term.

OpenAI Announces Sora A Text-To-Video Model

1. Introduction: OpenAI's Latest Innovations

In a significant leap forward, OpenAI unveils two groundbreaking advancements in artificial intelligence: GPT-4 Turbo and Sora. These innovations mark a milestone in AI language and visual processing, with implications reaching beyond traditional AI applications.

2. GPT-4 Turbo: Advancing Language Processing

OpenAI's GPT-4 Turbo emerges as the forefront AI language model, leveraging the most current training dataset available, up to December 2023. Surpassing expectations, this update provides users with the freshest and most relevant AI-driven language capabilities, surpassing the limitations of its predecessor, GPT-3.5.

3. Sora: Revolutionizing Visual Processing

Introducing Sora, OpenAI ventures into the realm of visual processing, offering a tool capable of generating high-resolution, cinematic scenes with intricate details and character interactions. This innovation signals a shift towards more immersive applications of artificial intelligence, particularly in the rapidly increasing metaverse sector.

4. Impact on Cryptocurrencies and the Metaverse

OpenAI's advancements have far-reaching implications for cryptocurrencies associated with the metaverse and AI-powered projects. With the growing importance of image processing in the metaverse, OpenAI's technologies promise to enhance user engagement and revolutionize virtual experiences, driving interest and investment in related cryptocurrency projects.

5. Conclusion: OpenAI's Growing Influence in AI and Beyond

With a valuation of $80 billion and growing international investor interest, OpenAI continues to lead the way in AI innovation. The integration of advanced AI technologies not only transforms traditional industries but also paves the way for futuristic applications, shaping the future of AI, the metaverse, and beyond.

A Green Light for XRP ETF?

A Green Light for XRP ETF? Ripple CEO Says "Yes"

In a recent interview on Bloomberg TV, Ripple CEO Brad Garlinghouse shed light on the ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) and expressed Ripple's openness to the potential launch of XRP exchange-traded funds (ETFs). Here are the key highlights from the interview:

Navigating the SEC Dispute: "We Won Against the SEC"

- Garlinghouse emphasized Ripple's consistent advocacy for clearer rules and regulations in the crypto space amidst the legal dispute with the SEC.

- He expressed satisfaction with the court's decision in the Ripple case, asserting that XRP was determined not to be a security.

- Despite the victory, Garlinghouse acknowledged the uncertainty surrounding the resolution's timeline, mentioning the possibility of an SEC appeal or congressional intervention.

Conformity of XRP ETFs

- While previously noncommittal about XRP ETFs, Garlinghouse now welcomes the possibility, likening it to the evolution of the stock market.

- He emphasized Ripple's openness to multiple ETFs around different tokens as a means of diversifying risk in the market.

Ripple's Regulatory Compliance

- Garlinghouse highlighted Ripple's commitment to compliance and regulatory engagement, citing the importance of custody solutions for institutional success in the crypto sphere.

- He emphasized a compliance-first mindset for the crypto industry, particularly in light of Ripple's acquisitions, such as Standard Custody.

Ripple's Advocacy in Political and Regulatory Leadership

- Garlinghouse discussed Ripple's involvement in political and regulatory advocacy efforts, aiming to support pro-crypto candidates advocating for constructive regulation and innovation.

- He addressed regulatory challenges faced by the crypto industry, including Senator Elizabeth Warren's stance on AML and KYC laws, arguing against the notion that crypto circumvents these regulations.

OPTIMISM Sends Out $41M Worth In Fourth Airdrop!

QUICK TAKE: Optimism's Fourth Airdrop Rewards NFT Artists

In a recent move, Optimism, the developer of the Ethereum Layer 2 OP Mainnet, has announced its fourth airdrop, with a focus on rewarding web3 artists. Here are the key points:

- Airdrop Details:

- Over 10.3 million OP tokens, valued at approximately $40.8 million, were distributed to 22,998 addresses in the airdrop.

- Eligible users who created engaging NFTs on the Ethereum Mainnet or Optimism's Superchain before January 10 are entitled to claim rewards.

- The deadline for claiming tokens was set for February 13, 2025.

- Airdrop Criteria:

- Users who created NFT art between January 10, 2023, and January 10, 2024, on either the Ethereum mainnet or Optimism's Superchain were eligible for rewards.

Rewards were based on the gas spent by other users while minting or trading the NFTs, with more popular projects receiving higher rewards.

- Bonus Eligibility:

- Bonus eligibility criteria included activities such as creating an NFT contract before January 10, 2023, being active on the Superchain since November 11, 2023, and others.

- The extent of the increase in token allocations depended on the number of qualifying bonus activities.

- Previous Airdrops:

- Optimism conducted its first airdrop on May 31, 2022, followed by the second on February 8, 2023, and the third on September 13, 2023.

- The third airdrop distributed 19.4 million OP tokens worth $26 million at the time to nearly 32,000 addresses engaged in delegation activities.

- Remaining Token Supply and Price:

- Optimism noted approximately 560 million OP tokens remaining for future airdrops.

- As of the report, the OP token traded at $3.94, with a circulating supply of 957.4 million and a total supply of 4.3 billion.

Optimism's airdrop initiative underscores its commitment to incentivizing and supporting NFT artists while promoting positive-sum behavior within the crypto ecosystem.

Bitcoin ETFs Threaten Gold’s Dominance

Bitcoin ETFs Challenge Gold ETF Dominance as Institutional Demand Fuels Rally

In a remarkable shift since their SEC approval, Bitcoin ETFs have quickly gained momentum in the market, posing a significant challenge to the longstanding dominance of gold ETFs. Here's a breakdown of the key developments:

- Rapid Rise of Bitcoin ETFs:

- Bitcoin ETFs have amassed approximately $37 billion in assets in just 25 trading days since their approval.

- This rapid growth has narrowed the gap between Bitcoin ETFs and gold ETFs, which have accumulated $93 billion over more than 20 years of trading.

- Expert Analysis:

- Bloomberg's Senior Commodity Strategist, Mike McGlone, notes the shifting landscape, stating that tangible gold is losing appeal to intangible Bitcoin.

- Factors such as the resilience of the US stock market, the strength of the US dollar, and 5% interest rates have presented challenges for gold.

- The emergence of Bitcoin ETFs in the US adds further competition to gold, especially as digitalization gains momentum globally.

- Diversification Recommendation:

- McGlone suggests that investors should consider diversifying their portfolios by incorporating Bitcoin or other digital assets to stay ahead in the evolving investment landscape.

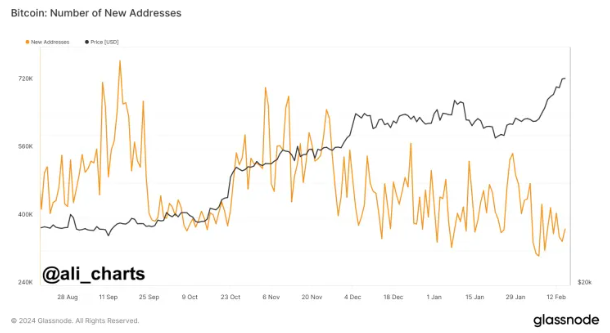

- Institutional Demand Driving Bitcoin Rally:

- Recent data indicates that the upward trend in Bitcoin prices is primarily fueled by institutional demand, while retail participation appears to be weaker.

- The decline in the creation of new Bitcoin addresses daily suggests reduced retail involvement in the current bull rally.

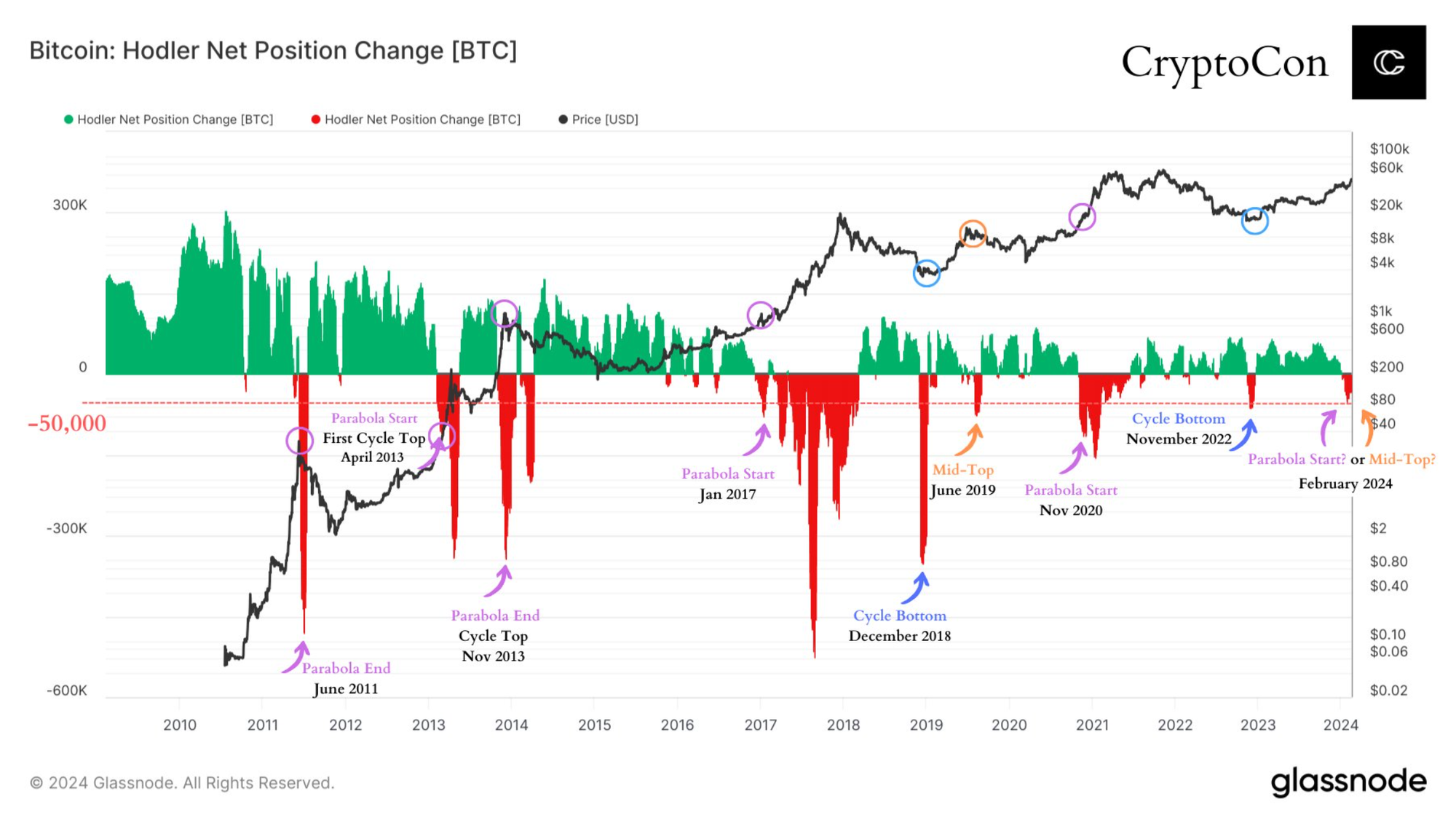

- Analysis of Long-Term Holder Positions:

- Market expert Crypto Con highlights a significant shift in long-term Bitcoin holder positions, potentially signaling a downside movement.

- The recent crossing of the position change line below -50.00 suggests a potential correction or change in trend, according to historical patterns.

- Contrasting Dynamics:

- While institutional demand continues to drive Bitcoin's price higher, long-term holders appear to be adjusting their positions or taking profits.

- The current market landscape presents a contrast between institutional influence and retail participation, with uncertainties about the direction of the next move.

- Price Action and Future Outlook:

- BTC is currently trading around $51,800, with sideways price action in the past 24 hours.

- The direction of the next move and the continued influence of institutions on Bitcoin's price action remain key factors to watch as spot Bitcoin ETFs gain traction.

The evolving dynamics between Bitcoin ETFs, gold ETFs, institutional demand, and retail participation will shape the future trajectory of the cryptocurrency market, indicating a potential paradigm shift in investment preferences and strategies.